TODAY—WEEKLY EXPORT SALES—MONTHLY NOPA CRUSH—

Overnight trade has SRW Wheat up roughly 6 cents; HRW up 5; HRS Wheat up 4, Corn is up 6 cents; Soybeans up 8 to 5 cents; Soymeal up $2.00, and Soyoil up 35 to 15 points.

Chinese Ag futures (September) settled up 41 yuan in soybeans, up 41 in Corn, up 37 in Soymeal, up 46 in Soyoil, and up 108 in Palm Oil.

Malaysian palm oil prices were up 61 ringgit at 3,791 (basis June) at midsession supported by improving exports.

U.S. Weather Forecast: An important precipitation event is still expected across much of the Hard Red Winter Wheat Region Thursday into Friday which will increase topsoil moisture more with a possible exception in the Texas Panhandle.

Last evening’s GFS model run was notably wet in South Dakota, southern Montana, and the southern half of North Dakota April 27 – 29. The model suggested as much as 1.00 to 4.00 inches of moisture in this area.

South America Weather Forecast: In Brazil, erratic shower and thunderstorm activity through the next ten days will still provide some relief from recent dryness. Conditions in Argentina will be mostly good; though, rain Monday through next Wednesday will cause some temporary disruption of fieldwork.

The player sheet had funds net buyers of 11,000 contracts of SRW Wheat; net bought 16,000 contracts of Corn; net bought 12,000 Soybeans; net bought 2,000 lots of Soymeal, and; bought 6,000 Soyoil.

We estimate Managed Money net long 17,000 contracts of SRW Wheat; net long 457,000 Corn; net long 153,000 Soybeans; long 58,000t Soymeal, and; net long 75,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 1,800 contracts; HRW Wheat down 3,400; Corn up 19,200; Soybeans up 11,100 contracts; Soymeal down 165 lots, and; Soyoil up 8,700.

There were changes in registrations (Soybeans down 45)—Registrations total 40 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 15; Soyoil 968 lots; Soymeal 175; Rice 1,013; HRW Wheat 1,291, and; HRS 235.

Tender Activity—Philippines seek 380,000t optional-origin milling/feed wheat—Japan bought 90,169t U.S./Canadian wheat—Algeria bought 200,000t optional-origin wheat—S. Korea bought 65,000t U.S. corn—

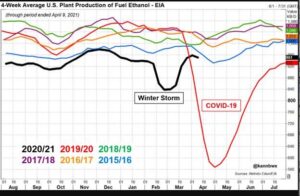

For the week ended Apr 9th, ethanol production was 941,000 barrels per day, down 3.5% versus a week ago, up 65.1% versus a year ago.

Stocks were 20.5 mil barrels, down 0.6% versus last week, down 25.3% versus last year.

Corn used was 95.1 mil bu versus 98.5 mil last week and versus the 97.2 mil needed to meet USDA projections.

NOPA March U.S. soy crush seen at 179.179 million bushels – survey – Reuters News

The U.S. soybean processing pace jumped in March following a smaller-than-expected crush the prior month, propelled in part by strong demand for vegetable oils to make biofuel.

NOPA members were estimated to have crushed 179.179 million bushels of soybeans in March. If realized, it would be the sixth-largest monthly crush on record and up significantly from February, when NOPA members processed just 155.158 million bushels, a 17-month low. But it would be below the March 2020 crush of 181.374 million bushels, which is a record for the third month of the year. Estimates ranged from 165.000 million to 189.645 million bushels.

The monthly NOPA report is scheduled for release at 11 a.m. CDT on Thursday.

Soyoil supplies at the end of March were seen at 1.822 billion pounds versus 1.757 billion pounds the prior month and 1.899 billion pounds at the end of March 2020. Stocks estimates ranged from 1.717 billion to 1.919 billion pounds.

U.S. corn production steady as sowings start in the Midwest – Refinitiv Commodities Research

—2021/22 US CORN PRODUCTION: 389 [353–429] MILLION TONS. As sowings are now officially underway, steady area and yield forecasts maintains 2021/22 U.S. corn production at 15.32 [13.9–16.9] billion bushels. Corn production totals are still expected up 8% from last season, benefiting mostly from acreage recovery after significant prevented plantings in 2019/20 and 2020/21, as well as potential record yields.

U.S. soybean sowings begin in the Mississippi Delta with minor delays – Refinitiv Commodities Research

—2021/22 U.S. SOYBEAN PRODUCTION: 120 [108–128] MILLION TONS. As sowings begin in the Mississippi Delta states with minor setbacks, steady area and yield forecasts maintain 2021/22 U.S. soybean production at 4.42 [4.02–4.69] billion bushels. Acreage is still seen at 87.7[83.6–92.1] million acres, on par with the March Prospective Plantings report that surprised a market expecting, in a pre-report survey, soybean plantings at 90.0 [86.1– 91.6] million acres.

Wire story reports projected U.S. corn supplies are still waning toward multi-year lows despite dragging ethanol output, though recent production and demand figures along with an upbeat outlook for the summer driving season should instill some optimism over the corn-based biofuel.

In the four weeks ended April 9, U.S. ethanol output averaged 951,000 barrels per day, off the recent highs observed in November and December and 6.6% below the 2017-2019 average for the same period. That departure from normal is a post-pandemic best. The latest production average reflects a slight downturn from the late March levels, somewhat consistent with seasonal trends for the time of year.

The U.S. Department of Agriculture’s statistics division is conducting a “deep dive” review of how it conducts its quarterly U.S. grain stocks reports, an official said. The quarterly reports are among the most market-sensitive releases from the USDA’s National Agricultural Statistics Service. The stocks figures, detailing the amount of major crops held on and off U.S. farms, are based on surveys of about 8,400 commercial grain facilities and roughly 80,000 farmers.

Cuba announced that it was loosening a decades-old ban on the slaughter of cattle and sale of beef and dairy as part of agricultural reforms as the Communist-run country battles with food shortages.

Ranchers will be allowed to do as they wish with their livestock after meeting state quotas and always with a guarantee it will not result in a reduction of the herd.

Persistent wet weather in south-centre slightly reduce China wheat production – Refinitiv Commodities Research

—2021/22 CHINA WHEAT PRODUCTION: 137 [133–141] MILLION TONS, Down <1% FROM LAST UPDATE

China soybean imports will surge in April/May amid arrivals of Brazilian soybeans – Refinitiv Commodities Research

—Refinitiv tracked 19.1 million tons of China soybean imports in the first quarter, compared to 16.2 million tons for last year’s same period. The imports were primarily originated from the U.S. (18.1 million tons). Brazilian soybean arrivals were about 1.0 million tons, compared to 7.3 million tons for last first-quarter. The slashed imports from Brazil were attributed to the depletion of 2019/20 Brazil soybean stocks and harvest delays of the new soybean crop.

A bid by agricultural commodities trader Bunge to extend its dominant role at a strategic Brazilian port’s public terminal for two years has been blocked by a temporary court decision. The decision is the latest twist in a long-running dispute between Bunge’s port agent Litoral Soluções and rivals who complain it has been granted a virtual monopoly at the public terminal, which sits adjacent to two private terminals, one owned by Bunge itself and another by a local unit of Japan’s Marubeni called Terlogs.

Argentina corn production down amid unfavorable early harvest weather – Refinitiv Commodities Research

Recent volatile weather conditions slightly lower Argentina soybean yields – Refinitiv Commodities Research

The Ukraine traders union UGA said it was concerned by the government’s plan to curb sunflower oil exports, which could cause a big fall in the amount of landed used for sunflower sowing and reduce the harvest. UGA is concerned about rumors of a desire of certain populists in the government to push through restrictions on exports of sunflower oil from Ukraine by the introduction of quotas and the establishment of zero quota.

Ukraine’s 2021 sunflower seed harvest is likely to rise to a record 16.4 million tonnes due to an expected 6% increase in the sowing area, analyst APK-Inform said on Wednesday.

The consultancy said farmers could sow 6.8-6.9 million hectares of sunflower this year.

Sunoil output could exceed 7 million tonnes in the 2021/22 September-August season, 16% more than Ukraine was able to produce in 2020/21, the consultancy said, adding Ukraine may export 6.5 million tonnes of sunoil next season.

It is too early to estimate the impact on grain crops from a severe frost that has hit France but there is some concern over damage in the central and southern parts of the country, farm office FranceAgriMer said. Temperatures have fallen well below zero for several nights in a row in many parts of France, the EU’s top grain producer, causing major damages to vineyards, orchards and sugar beet and prompting the government to promise financial aid.

German pig prices remained stable this week with sales inside Europe continuing to underpin following import bans on German pork last year by China and other Asian buyers, traders and industry sources said. Pig prices were unchanged on the week at 1.50 euros a kg slaughter weight, the same level as in March and up from 1.21 euros in February. Piglet prices were also unchanged at 53 euros per animal against only 32.50 euros in early February, the association said.

Indonesia’s exports surged in March due to higher commodity prices and rebounding global demand, while imports also grew by more than expected last month as domestic manufacturing activity improved, statistics bureau data showed. Merchandise exports beat forecast with an annual jump of 30.47% to $18.35 billion on rising shipments of oil, natural gas, palm oil, steel and coal. Export growth in March was the highest since July 2017, according to Refinitiv Eikon data, and compared with a Reuters poll forecast of 11.74%.

Indonesia expects to consume 9.6 million kilolitres of biodiesel in 2022, higher than the 9.2 million kilolitres targeted for this year, official data showed. By 2030, the data estimates the country will consume 14 million kilolitres of biofuel.

Indonesia’s biodiesel makers can export one million kilo litres (KL) biodiesel this year, Paulus Tjakrawan, vice president of Indonesia Biodiesel Producers Association said at the German industrial trade fair, Hannover Messe. It would be a jump from 2020’s 27,774 KL exports, the group’s data showed, due to the pandemic and to higher biodiesel blend requirement at home for the palm oil-based fuel.

Malaysia has kept its May export tax for crude palm oil at 8%. The world’s second-largest palm exporter calculated a reference price of 4,533.40 ringgit ($1,098.74) per tonne for May. The export tax structure starts at 3% for crude palm oil in a 2,250 to 2,400 ringgit-per-tonne range. The maximum tax rate is set at 8% when prices exceed 3,450 ringgit a tonne.

Malaysia April 1-15 Palm Oil Exports 583,875 Tons, Up 6.3%, SGS Says.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.