TODAY — EXPORT INSPECTIONS, CROP PROGRESS, STATS CANANDA

Wheat prices overnight are up 6 3/4 in SRW, up 7 3/4 in HRW, up 5 1/4 in HRS; Corn is down 3; Soybeans down 1; Soymeal up $0.20; Soyoil down 0.83.

Markets finished last week with wheat prices up 5 3/4 in SRW, up 14 1/4 in HRW, up 17 1/4 in HRS; Corn is up 15 1/4; Soybeans up 29 1/2; Soymeal up $0.67; Soyoil up 0.95.

For the month to date wheat prices are up 26 1/4 in SRW, up 47 1/2 in HRW, up 32 in HRS; Corn is up 5 1/2; Soybeans down 27; Soymeal up $0.50; Soyoil down 3.53.

Chinese Ag futures (JAN 22) Soybeans down 81 yuan ; Soymeal up 18; Soyoil up 2; Palm oil up 22; Corn down 6 — Malasyian Palm is down 80. Malaysian palm oil prices overnight were down 80 ringgit (-1.85%) at 4253.

Midwest corn, soybean and winter wheat forecasts: West: Scattered heavy showers north, isolated south. Temperatures above normal. East: Scattered heavy showers north, isolated south. Temperatures above normal. Forecast: West: Isolated to scattered showers south through Tuesday. Mostly dry Wednesday. Scattered showers Thursday-Friday. Temperatures near to above normal through Wednesday, above normal Thursday-Friday. East: Isolated to scattered showers south through Wednesday, could be heavy. Mostly dry Thursday. Isolated showers Friday. Temperatures above normal Monday, near to above normal Tuesday-Wednesday, near normal Thursday-Friday. 6 to 10 day outlook: Isolated to scattered showers Saturday-Wednesday. Temperatures near to above normal Saturday-Sunday, near normal Monday-Wednesday.

The player sheet for Aug. 27 had funds: net sellers of 3,000 contracts of SRW wheat, buyers of 2,500 corn, sellers of 3,000 soybeans, sellers of 2,000 soymeal, and buyers of 1,500 soyoil.

Preliminary changes in futures Open Interest as of August 27 were: SRW Wheat down 13,820 contracts, HRW Wheat down 3,891, Corn down 31,309, Soybeans down 6,804, Soymeal down 4,034, Soyoil down 5,191.

There were no changes in registrations. Registration total: 0 SRW Wheat contracts; 0 Oats; 0 Corn; 0 Soybeans; 249 Soyoil; 1 Soymeal; 1,288 HRW Wheat.

TENDERS

- WHEAT TENDER: Egypt’s General Authority for Supply Commodities (GASC) set a tender to buy an unspecified amount of wheat from global suppliers for shipment from Oct. 15-25, for payment using 180-day letters of credit. Tenders were due into GASC by noon (1000 GMT) on Aug. 30, and results were expected on the same day.

- SOYBEAN SALE: The U.S. Department of Agriculture confirmed private sales of 129,000 tonnes of U.S. soybeans to China for delivery in the 2021/22 marketing year that begins Sept. 1.

- CORN SALE: The USDA also confirmed private sales of 150,000 tonnes of U.S. corn to Colombia for 2021/22 delivery.

- CORN TENDER: The Korea Feed Association (KFA) issued an international tender to purchase up to 138,000 tonnes of corn to be sourced from optional origins, European traders said. The deadline for submission of price offers in the tender is Aug. 27, they said.

PENDING TENDERS

- FEED WHEAT TENDER: An importer in the Philippines is tendering to purchase an estimated 60,000 tonnes of animal feed wheat

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins

- WHEAT TENDER: Turkey’s state grain board TMO issued an international tender to purchase about 300,000 tonnes of milling wheat

- WHEAT TENDER: The Taiwan Flour Millers’ Association issued an international tender to purchase 48,875 tonnes of grade 1 milling wheat to be sourced from the United States

- WHEAT FLOUR TENDER: The state purchasing agency in Mauritius issued an international tender to buy 47,000 tonnes of wheat flour to be sourced from optional origins

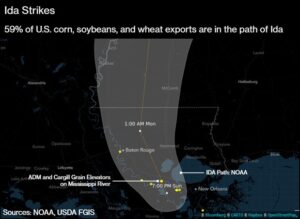

Hurricane Ida Takes Direct Aim at 59% of Key U.S. Ag Exports

Key agricultural export elevators on the Mississippi River were in the direct path of Hurricane Ida, according to Bloomberg News analysis.

Mississippi River elevators owned by Archer-Daniels-Midland, Cargill, CHS, Bunge and Zen Noh are used to load and inspect bulk shipments of corn, soybeans, and wheat to send overseas, and appeared to be in the direct path of the storm.

59% of U.S. seaborne shipments by bulk carrier in 2021 have been sent via the Mississippi, with China the largest destination, taking some 14.5 million tons of agricultural goods, including 10.8 million tons of corn.

ADM and Bunge had earlier announced elevator closures ahead of the storm. At least eight bulk carriers intending to load at Mississippi elevators were caught in the storm’s path.

U.S. Beef Production Falls 2.1% This Week, Pork Down: USDA

U.S. federally inspected beef production falls to 532m pounds for the week ending Aug. 28 from 544m in the previous week, according to USDA estimates published on the agency’s website.

- Cattle slaughter down 2.1% from a week ago to 651m head

- Pork production down 0.2% from a week ago, hog slaughter unchanged

- For the year, beef production is 3.9% above last year’s level at this time, while pork is 1.5% below

Brazil 2021/22 C-S Summer Corn Area Seen +0.7%: Safras

Summer corn planted area 2021/2022 at Center-South of Brazil should occupy 4.38m hectares, 0.7% above 2020/2021 crop, according to Safras estimates.

- In July, estimated area for 2021/2022 was slightly larger, at 4.4m hectares

- 2021/22 average yield seen at 5,827 kg/ha, previous estimate 4,973 kg/ha

SovEcon Sees Russian Wheat Exports at Lowest in Four Years

Russian wheat exports in the 2021-22 season are now seen at 33.9m tons, down 3.2 m tons from a prior estimate, consultant SovEcon says in an emailed report.

- Forecast would be the lowest export volume since 2016-17 season when it was 27.8 m tons

- Lower estimate reflects earlier revision of the crop forecast, slow current export pace and strong competition with other suppliers

- SovEcon expects a relatively slow pace of exports in August and the next few months

- August wheat shipments are estimated at 4.3m tons, down 9% y/y

- Domestic grain prices are rising actively, and changes in the export tax can hardly be predicted

Russian Wheat Exports Fall 13% So Far This Season: Agency

Wheat shipments for the 2021-22 season totaled 6.2m tons as of Aug. 26, the Federal Center of Quality and Safety Assurance for Grain and Grain Products said on its website, citing inspections before exports.

- That means wheat exports totaled about 1.6m tons in the week to Aug. 26, compared with about 800k tons a week before

- Exports of all grains are at 7.4m tons so far this season

Russia’s grain export estimates for August by Sovecon consultancy

Russia’s August exports of wheat, barley and maize (corn) are estimated at 4.8 million tonnes, up from 1.9 million tonnes in July, the Sovecon agriculture consultancy said.

USDA forecast: Agricultural exports to hit record high in FY2022

Fueled in part by an expected increase in Chinese purchases, the U.S. is projected to export a record $177.5 billion worth of agricultural goods in fiscal year 2022, according to the Agriculture Department’s latest trade outlook.

Agricultural exports to China are expected to hit $39 billion in FY2022, according to the report, which cites higher prices for soybeans and sorghum as leading factors behind a projected $2 billion increase over FY2021. The fiscal year begins on Oct. 1.

The report does not mention the phase-one trade agreement between the United States and China, which is set to expire in December. The deal stipulates that China must increase its purchases of American agricultural goods by $19.5 billion in 2021 from a baseline of $19.6 billion in 2017 — the last year before trade tensions flared between the U.S. and China after the Trump administration began to hit Chinese imports with Section 301 tariffs.

China will remain the top destination for U.S. agricultural exports in FY2022, the report says.

USDA also has revised its forecast for FY2021, predicting a total of $173.5 billion in ag exports — an increase of $9.5 billion over its projection in May. The increase is due to higher livestock, poultry and dairy exports and an expanded definition of “agricultural products,” the report says. USDA has adopted the World Trade Organization definition of the term, which “adds ethanol, distilled spirits, and manufactured tobacco products, among others, while removing rubber and allied products from the previous USDA definition,” the outlook says.

SOYBEAN/CEPEA: Domestic and international soybean prices follow opposite directions

Soybean prices have dropped in the Brazilian market this week, due to the dollar depreciation against the Real (by 3.1% between August 19 and 26, to 5.25 BRL on Thursday, 26), once the premiums did not offset the decrease of the American currency. As regards crops, the beginning of sowing activities is near, and, despite the current high profitability of soybean, the weather and the high production costs are still concerning farmers in Brazil.

On the other hand, in the United States, soybean prices increased in the last days, influenced by data showing that crops conditions have worsened, which may reduce productivity amid low world inventories.

The Brazilian exports of soybean have been high, totaling five million tons this month (considering the three first weeks), according to data from Secex (Foreign Trade Secretariat). The daily average of shipments is nearly 20% higher than that in August/20, and the price received in dollar, 36.4% up from that a year ago. On the average of 2021, Brazil has exported 71 million tons of soybean (Secex).

EXPECTATIONS FOR 2021/22: The area allocated to soybean crops in Brazil has been growing for 15 years. For the 2021/22 season, Conab (Brazil’s National Company for Food Supply) estimates the soybean area to total 39.91 million hectares, 3.6% larger than that in the previous season. The Brazilian soybean output may total 141.26 million tons, 3.9% up from that in the previous season (135.98 million tons), keeping Brazil as the major soybean-producing country in the world in 2022.

Soybean exports in the 2020/21 and the 2021/22 seasons are expected to set records, estimated at 83.42 and at 87.58 million tons, respectively. The demand from China is supposed to increase, according to Conab.

Besides, soybean production costs are currently high in Brazil, influenced by the strong dollar. This scenario keeps farmers cautious when selling the product from the 2021/22 season – so far, 30% has been sold, against 60% in the same period last season, according to the agents consulted by Cepea.

CORN/CEPEA: With disinterested purchasers, corn prices drop in most Brazilian regions

Cepea, August 27 – Corn prices are fading in most Brazilian regions surveyed by Cepea, reflecting the disinterest of purchasers, who expect prices to decrease more. As regards sellers, as the harvesting is advancing and supply is increasing in the national spot market, some of these agents have been willing to lower asking prices, aiming to take advantage of the current price levels and to make cash flow to pay debts.

CROPS – Farmers are waiting for the return of rains in most Brazilian regions in order to begin preparing the summer crop. As for the harvesting of the second crop, in Mato Grosso, activities had reached 99.69% of the area until late last week, according to Imea.

In Paraná, the weather is favoring activities, and, according to Seab/Deral, 64% of the second crop (2020/21) had been harvested until August 23. According to Seab/Deral, 5% of crops are in good conditions; 37%, in average conditions; and 58%, in bad conditions. A report from Seab has revised down production estimates, to 5.9 million tons, 186 thousand tons down from that reported in July.

In Mato Grosso do Sul, according to Famasul, the harvesting had reached 58% of the state area until August 20. In Rio Grande do Sul, corn sowing is beginning to advance faster, majorly in irrigated areas. Many farmers anticipated sowing to take advantage of the rains forecast for the coming days.

Mississippi River Is Flowing in Reverse as Ida Pushes Inland

The Mississippi River is flowing in reverse in southeastern Louisiana as Hurricane Ida forces vast volumes of sea water ashore, according to flood-control authorities.

At least one ferry broke loose from its moorings along the river, said Kelli Chandler, regional director of the Southeast Louisiana Flood Protection Authority-East. Storm surges from hurricanes and tropical systems in the Gulf of Mexico have been known to push the north-to-south flowing Mississippi in reverse.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.