TOP HEADLINES

Argentina soybean harvest may be biggest in years, expert says

Argentina’s 2023/24 soybean production could top recent harvests thanks to the abundant rains expected to water fields in the coming months, spurred by the climate phenomenon known as El Nino, a meteorologist said on Thursday.

Argentina had long been the world’s top exporter of soybean oil and meal, but a historic drought caused it to move into second place, behind Brazil, this year with the 2022/23 soybean crop.

But El Nino, which intensifies rains in Argentina’s key agricultural region, is expected to bring the 2023/24 harvest back up to normal levels or even higher, said German Heinzenknecht, a meteorologist at the Applied Climatology Consultancy (CCA).

“El Nino’s effects came a bit slowly in the beginning for the core agricultural region, but they’re now showing more promising signs,” Heinzenknecht said.

“We can hope for a season with much better results compared to the past five years,” he added, explaining that average to above-average precipitation was expected through March.

Between the 2018/19 and 2021/22 harvests, Argentina’s soybean output ranged from 43.1 million metric tons to 54.5 million tons, according to the Buenos Aires Grains Exchange. Last season, however, output fell sharply to just 21 million tons due to the drought.

Argentina’s soy harvest this season is estimated at 50 million tons, the Rosario Grains Exchange said.

After scattered showers on Wednesday, more rainfall is expected on Friday, followed by a brief dry spell that will give farmers time to plant their crops, Heinzenknecht said.

“Widespread rains are seen again throughout the Pampas region, with the highest concentration of precipitation reaching part of the core agricultural area topping 30, 40 millimeters,” he said.

Argentine farmers are wrapping up planting of the early soybean crop and kicking off late-season corn planting.

“First-round soybeans will be planted with very good levels of moisture reserves,” Heinzenknecht said.

Although El Nino rains could cause excess moisture in isolated areas, it should not affect the crop on a national level, he added.

FUTURES & WEATHER

Wheat prices overnight are down 6 3/4 in SRW, down 9 1/4 in HRW, down 9 in HRS; Corn is down 2; Soybeans down 14 3/4; Soymeal down $5.60; Soyoil up 0.04.

For the week so far wheat prices are up 14 in SRW, up 22 1/4 in HRW, up 6 in HRS; Corn is down 2; Soybeans down 2 3/4; Soymeal down $15.70; Soyoil up 2.01.

In November wheat prices were up 14 in SRW, up 14 in HRW, down 6 3/4 in HRS; Corn down 17; Soybeans up 55 3/4; Soymeal up $11.20; Soyoil up 0.87.

Year-To-Date nearby futures are down 28.1% in SRW, down 27.4% in HRW, down 25.2% in HRS; Corn is down 32.3%; Soybeans down 12.6%; Soymeal down 8.9%; Soyoil down 17.8%.

Chinese Ag futures (JAN 24) Soybeans down 44 yuan; Soymeal down 22; Soyoil down 70; Palm oil down 52; Corn down 5 — Malaysian Palm is down 24. Malaysian palm oil prices overnight were down 24 ringgit (-0.62%) at 3871.

There were changes in registrations (220 Corn, 100 HRW Wheat). Registration total: 2,946 SRW Wheat contracts; 522 Oats; 224 Corn; 596 Soybeans; 62 Soyoil; 0 Soymeal; 557 HRW Wheat.

Preliminary changes in futures Open Interest as of November 30 were: SRW Wheat down 4,115 contracts, HRW Wheat down 2,734, Corn down 4,809, Soybeans up 4,067, Soymeal down 1,333, Soyoil down 2,138.

Brazil: Scattered showers continue in central Brazil, but at a reduced coverage and intensity thanks to El Nino. Forecasts have these showers picking up again this weekend as a front moves into the region and continuing through next week, beneficial for soybean development. The southern state of Rio Grande do Sul has seen a bit of a break in the excessive rain over the last several days. Any break is beneficial to help soils drain. A front moving through this weekend could bring some heavier rain back through, and the forecast continues to call for above-normal rainfall through December in this region.

Argentina: A front brought widespread showers to the country the last couple of days and another provides similar rainfall for Thursday and Friday, bringing good rainfall to much of the country’s growing regions. Additional showers may continue in some areas over the weekend and next week as well. Overall, conditions are mostly favorable for corn and soybean planting and development.

Australia: Scattered showers continue over eastern areas through Friday, helping to ease extremely dry conditions in a lot of this part of the country. It is too late for wheat and canola, which is delaying harvest and could cause quality issues instead, but will help developing cotton and sorghum. Western areas continue to be too dry with little precipitation forecast for the next week and eastern areas will join them next week.

Northern Plains: Outside of a small clipper bringing some light showers early next week, it continues to be dry in the region with the activity either staying north or south through next week. Temperatures will be warmer compared to normal for the next couple of weeks.

Central/Southern Plains: Warmer temperatures have largely melted off the snow from last week, building a little soil moisture for wheat. A storm system will bring scattered showers to the region Thursday and Friday and may include a little snow on its northern edge. Some isolated showers will be possible over the weekend but the region will be drier next week as temperatures rise well above normal.

Midwest: Scattered showers will move through with a system Thursday and Friday with more streaks of showers this weekend into early next week. It will be mostly rain, though some snow may mix in for a few areas. The precipitation will help to build soil moisture and ease drought that remains. Temperatures will be more moderate for at least the first half of December and will rise well above normal by the middle of next week.

Delta: A storm system will bring scattered showers and thunderstorms through Thursday into Friday and the south may stay active for Saturday as well. Heavier rain will help to ease drought conditions in some areas, though there is a long way to go. Precipitation farther north will help to increase water levels on the Mississippi River at least a little bit, but the river system needs more consistent precipitation.

The player sheet for Nov. 30 had funds: net buyers of 4,000 contracts of SRW wheat, buyers of 4,500 corn, buyers of 2,500 soybeans, sellers of 2,000 soymeal, and sellers of 1,500 soyoil.

TENDERS

- OYBEAN SALES: The U.S. Department of Agriculture confirmed private sales of 134,000 metric tons of U.S. soybeans to China for delivery in the 2023/24 marketing year that began Sept. 1.

- WHEAT PURCHASE: The Taiwan Flour Millers’ Association purchased an estimated 109,325 metric tons of milling wheat to be sourced from the United States in a tender on Thursday.

- FEED BARLEY PURCHASE: Jordan’s state grain buyer has purchased about 60,000 metric tons of animal feed barley to be sourced from optional origins in an international tender that closed on Thursday.

PENDING TENDERS

- SUGAR TENDER: Egypt’s General Authority for Supply Commodities announced a tender to import 50,000 tonnes of raw sugar and/or 50,000 tonnes of refined white sugar, all from any origin, on behalf of the Egyptian Sugar & Integrated Industries Company. The deadline for offers was Nov. 25.

- NON-GMO SOYBEAN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued international tenders to purchase around 20,000 metric tons of food-quality soybeans free of genetically-modified organisms (GMOs)

- MILLING WHEAT TENDER: The Lebanese government issued an international tender to purchase 30,000 metric tons of milling wheat

- MILLING WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 metric tons of milling wheat.

- WHEAT TENDER: A government agency in Pakistan issued an international tender to purchase and import 110,000 metric tons of wheat.

TODAY

US Agriculture Export Sales for Week Ending Nov. 23

USDA releases net export sales report on website for week ending Nov. 23.

- Soybean sales rose to 1,895k tons vs 970k in the previous week

- Corn sales rose to 1,928k tons vs 1,432k in the previous week

- All wheat sales rose to 635k tons vs 197k in the previous week

US Export Sales of Soybeans, Corn and Wheat by Country

The following shows US export sales of soybeans, corn and wheat by biggest net buyers for week ending Nov. 23, according to data on the USDA’s website.

- Top buyer of soybeans: China with 892k tons

- Top buyer of corn: Unknown Buyers with 727k tons

- Top buyer of wheat: China with 197k tons

US Export Sales of Pork and Beef by Country

The following shows US export sales of pork and beef product by biggest net buyers for week ending Nov. 23, according to data on the USDA’s website.

- Mexico bought 7.8k tons of the 26.8k tons of pork sold in the week

- South Korea led in beef purchases

CROP SURVEY: US Soybean Crush and Corn for Ethanol

The following is from a Bloomberg survey of six anlaysts.

- Soybean crush seen at 199.2m bu in Oct., a 1.3% rise from a year ago

- Crude and once-refined soybean-oil reserves at end of October seen at 1.577b lbs, down from 2.094b

- Corn used in ethanol production seen up 0.9% y/y to 452.7

USDA October soy crush estimated at record 201.1 million bushels -analysts

The U.S. soybean crush likely jumped to a record 6.033 million short tons in October, or 201.1 million bushels, while soyoil stocks thinned for a sixth straight month, according to analysts surveyed by Reuters ahead of a monthly U.S. Department of Agriculture (USDA) report.

The crush topped 200 million bushels for the first time ever as a recently expanded and still growing U.S. soy processing industry crushed greater volumes of newly harvested beans amid rising vegetable oil demand from biofuel makers.

If the crush estimate, gathered from seven analysts, is realized, it would be up 15.1% from the 174.7 million bushels processed in September and up 2.3% from the 196.6 million bushels crushed in October 2022. It would also eclipse the previous record monthly crush of 198.2 million bushels in December 2021.

Estimates ranged from 198.0 million to 202.5 million bushels, with a median of 201.8 million bushels.

The USDA is scheduled to release its monthly fats and oils report at 2 p.m. CST (2000 GMT) on Friday, Dec. 1.

U.S. soyoil stocks as of Oct. 31 were estimated at 1.540 billion pounds, based on the average of estimates from four analysts.

If realized, the stocks would be down 3.9% from 1.602 billion pounds at the end of September and down 26.5% from stocks totaling 2.094 billion pounds at the end of October 2022. The stocks would also be the tightest on record, based on USDA data that goes back to May 2015.

Estimates ranged from 1.500 billion to 1.599 billion pounds, with a median of 1.530 billion pounds.

The National Oilseed Processors Association reported that its members, which account for about 95% of the U.S. soy crush, processed a record 189.774 million bushels last month, up 14.7% from September and up 2.9% from the October 2022.

NOPA soyoil stocks as of Oct. 31 fell to 1.099 billion pounds, the lowest since December 2014.

Canada 2023 Crop Production Survey Ahead of StatsCan Report

The following table shows results of a Bloomberg survey of as many as six analysts about 2023 crop production in Canada.

- Statistics Canada in Ottawa is scheduled to release its estimates on Dec. 4 at 8:30am ET

- Analysts see 0.7% more wheat production in 2023 than StatsCan’s previous est., according to the avg in the survey

- Estimates range from 29.3m to 30.9m metric tons

- Canola seen 4.4% higher than the previous est.

Argentine Soy, Corn, Wheat Estimates Nov. 30: Exchange

The Buenos Aires Grain Exchange releases weekly report on website.

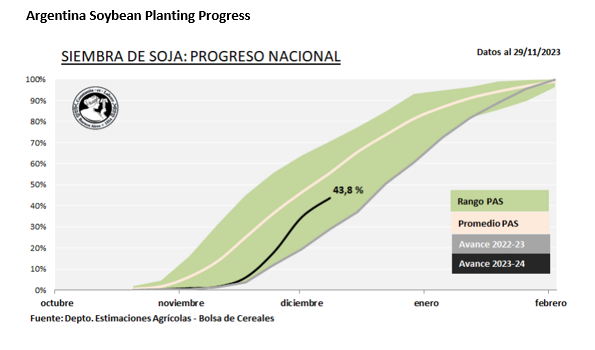

- 2023-24 corn planting advanced to 32% complete from 26% in the previous week

- 2023-24 soybean planting advanced to 44% complete

Brazil’s 2024 soy production to fall below last season’s, Patria forecasts

Brazil’s soybean crop will reach 150.67 million metric tons in the 2023/24 cycle, below last season’s 154.10 million tons, consultancy Patria Agronegocios said on Thursday, as it factors in the effects of a severe drought in key producing states.

The projection represents a 2.2% drop from Brazil’s soy output in the 2022/23 cycle, Patria said. It is the first seen by Reuters that predicts a smaller soy production for the current season compared with the previous one.

In relation to the consultancy’s previous soy crop estimate, the projection implies a 5.14 million tons fall for soy output in Brazil, the world’s largest producer and exporter of the commodity.

Thursday’s cut also represents one of the most aggressive by any private forecaster so far in the season, which began in mid-September in top grain supplier Mato Grosso state.

After farmers started planting their new crop, projections hovered around 164 million tons.

“Yield reductions were noted in almost all the main producing states, especially Center-West ones, Northeast and Tocantins (in the North),” Patria said.

The consultancy cited a delayed planting cycle as a reflection of “evident water stress” in parts of Rondonia, Mato Grosso, Goias and Tocantins, as well as and low germination quality amid high temperatures in those areas.

Patria also predicted a massive drop in Brazil’s output of second corn, which is planted after soybeans are harvested in the same areas and represents around 75% of total national corn output in a given year.

Delays in the soy season will reduce second corn’s planted area, farmers said , as they don’t want to risk sowing the cereal after the ideal climate window.

Patria pegged Brazil’s second corn crop at 82.45 million tons in 2023/24, down around 18 million tons from last season.

Ukraine’s Grain Exports Drop 28% Y/y in Season to Dec. 1

Ukraine’s grain exports in the marketing year that started on July 1 stand at 13.1m tons, versus 18.1m tons at a similar time a year earlier, the Agriculture Ministry said on its website.

The total includes:

- 5.9m tons of wheat, down 14% y/y

- 874k tons of barley, down 41% y/y

- 6.2m tons of corn, down 36% y/y

Ukraine’s Grain Harvest Advances 34% From Last Year as of Dec. 1

Ukraine’s grain harvest advanced to 56.3m tons as of Friday compared with Dec. 2 last year, Agriculture Ministry says on website.

The total includes:

- 22.5m tons of wheat, up 16% y/y

- 5.9m tons of barley, up 5.4% y/y

- 26m tons of corn, up 68% y/y

EU Cuts Barley Estimates, Corn and Wheat Seen Steady

This year’s soft-wheat harvest is now seen at 125.6m tons, a marginal increase from an October estimate of 125.5m tons, the European Commission said Thursday in a report.

- Export estimate remained the same at 31m tons

- Corn crop estimate remained steady at 59.9m tons

- Barley crop estimate cut to 46.9 m tons, from 47.5m tons

US Miss. River Grain Shipments Rise, Barge Rates Decline: USDA

Barge shipments down the Mississippi river increased to 928k tons in the week ending Nov. 25 from 743k tons the previous week, according to the USDA’s weekly grain transportation report.

- Barge shipments of corn rose 48.9% from the previous week

- Soybean shipments up 3.8% w/w

- St. Louis barge rates were $15.04 per short ton, a decline of $0.64 from the previous week

USDA Raises Estimate of 2023 Farm Income to $151 Billion

The USDA revised up its estimate of US farmer profits by $9.8 billion from its previous estimate in August, according to the Farm Income and Financial Forecasts report released Thursday on the agency’s website.

- Compared to 2022, income expected to fall by 17%

- Gross income cut by $4.9b from August, while expenses lowered by $14.7b

- Income from crops cut by $2.8b, and from livestock lowered by $1.1b

US Crops in Drought Area for Week Ending Nov. 28: USDA

The following table shows the percent of US agricultural production within an area that experienced drought for the week ending Nov. 28, according to the USDA’s weekly drought report.

- Winter wheat experiencing moderate to intense drought fell to 38% from 41%

- Drought exposure at this time last year was 74%

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.