TODAY

Wheat prices overnight are up 3 in SRW, up 1 3/4 in HRW, up 1 in HRS; Corn is up 3 1/4; Soybeans up 1 1/4; Soymeal unchanged; Soyoil up 0.39.

For the week so far wheat prices are up 6 1/2 in SRW, up 5 in HRW, down 8 in HRS; Corn is down 3 3/4; Soybeans down 24 1/4; Soymeal down $0.87; Soyoil down 0.36. For the month to date wheat prices are down 5 3/4 in SRW, down 21 1/2 in HRW, down 66 3/4 in HRS; Corn is up 9 3/4; Soybeans up 46 3/4; Soymeal up $17.20; Soyoil up 1.89.

Chinese Ag futures (MAY 22) Soybeans down 36 yuan; Soymeal down 3; Soyoil up 24; Palm oil up 16; Corn down 3 — Malasyian Palm is up 40. Malaysian palm oil prices overnight were up 40 ringgit (+0.80%) at 5069.

There were changes in registrations (-81 Soybeans). Registration total: 1,900 SRW Wheat contracts; 25 Oats; 50 Corn; 400 Soybeans; 143 Soyoil; 0 Soymeal; 92 HRW Wheat.

Preliminary changes in futures Open Interest as of January 10 were: SRW Wheat down 536 contracts, HRW Wheat down 809, Corn down 2,144, Soybeans up 6,715, Soymeal up 1,613, Soyoil up 5,193.

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana Forecast: Isolated showers north through Friday. Temperatures near to above normal through Friday. Mato Grosso, MGDS and southern Goias Forecast: Scattered showers through Thursday. Isolated showers Friday. Temperatures near normal through Friday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires Forecast: Mostly dry through Friday. Temperatures above to well above normal through Friday. La Pampa, Southern Buenos Aires Forecast: Mostly dry through Friday. Temperatures above to well above normal through Friday.

The player sheet for Jan. 10 had funds: net buyers of 2,000 contracts of SRW wheat, sellers of 11,000 corn, buyers of 14,000 soybeans, sellers of 4,500 soymeal, and sellers of 3,500 soyoil.

TENDERS

- CORN SALE: The U.S. Department of Agriculture confirmed private sales of 77,000 of U.S. corn to Mexico for delivery in the 2021/22 marketing year and 55,000 tonnes for delivery in 2022/23.

- CORN SALE: The Korea Feed Association (KFA) purchased about 130,000 tonnes of corn in an international tender for up to 136,000 tonnes which closed on Monday

- WHEAT TENDER UPDATE: Iraq’s state grains buyer has extended the deadline for validity of price offers in tender to buy a nominal 50,000 tonnes of milling wheat in which only a limited number of trading companies were asked to participate

PENDING TENDERS

- RICE TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of rice with import using land transport by railway

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins

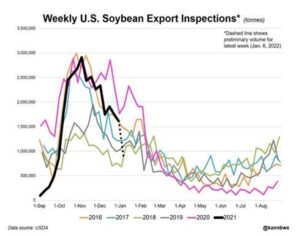

U.S. Inspected 1.023m Tons of Corn for Export, 905k of Soybean

In week ending Jan. 6, according to the USDA’s weekly inspections report.

- Soybeans: 905k tons vs 1,614k the previous wk, 1,909k a yr ago

- Corn: 1,023k tons vs 760k the previous wk, 1,345k a yr ago

- Wheat: 233k tons vs 230k the previous wk, 281k a yr ago

Brazil 2021-22 Soy Harvest 0.2% Done as of Jan. 6: AgRural

Harvest had not yet started at the same time last year, AgRural says in emailed report.

- In Parana state, harvest advances in the west and southwest, the most punished regions by drought

- In some fields, the averages have been between 5 and 16 bags per hectare, AgRural says

- In Mato Grosso state, the works are concentrated in the west and mid-north and the first reports are of good productivity and well isolated complaints from excess moisture and damaged grains

Paraguay Soy Crop ‘Practically Cooked’ by Drought, Chamber Says

Paraguay’s key first soy harvest might not even reach 6m metric tons compared with almost 9m tons the previous year as dry weather cuts yields, Hugo Pastore, executive director of grain and oilseed export chamber Capeco, said in a telephone interview.

- Some veteran soy farmers say this could be the worst first harvest in decades: Pastore

- Lack of rain, low humidity and high temperatures “practically cooked” the crop leading to “enormous losses in quantity and quality,” Pastore said

- Just over 30% of the first harvest is done with most farmers seeing yields below the 2,000 kilos per hectare that landowners need to break even

- Farmers will try to recover some losses by planting a bigger second soy crop, which Pastore said could cover as much as 900k hectares

- The lack of seeds for the second crop has led some farmers to use high-quality first harvest soy

- Paraguay produced about 9.4m tons of soy from its two harvests in the 2020-21 season

- Paraguay River ports will probably handle most of the country’s soy exports this year with stretches of the Parana River expected to be unnavigable through late February at least

- Barges plying the Paraguay River are currently operating at 70% capacity

WHEAT/CEPEA: Early 2022 registers low liquidity

In this beginning of 2022, there are just a few producers and purchasers operating in the domestic wheat market. Many players are evaluating the market, while wheat mills claim they have inventories. Despite this scenario, prices have increased in the domestic market, influenced by the dollar valuation against Real.

Cepea surveys show that, between Dec. 30 and Jan. 7, the prices paid to wheat farmers rose by 0.98% in Rio Grande do Sul, by 1.46% in Santa Catarina and by 0.47% in Paraná. In the wholesale market (deals between processors), prices upped 0.84% in São Paulo, 0.18% in Paraná and 2.3% in Santa Catarina. On the other hand, in Rio Grande do Sul, quotes decreased 1.05%. In the same period, the US dollar increased by 1.04% against the Real, to BRL 5.633 on January 7.

Data from Conab (between Dec. 27 and 31) indicate that the import parity (Argentina origin) was 320.25 USD/ton for the product in Paraná. Considering the dollar average at BRL 5.6257, the imported product was traded at 1,801.66 BRL/ton. The price average for the Brazilian product in Paraná was 1,665.47 BRL/ton, according to Cepea.

IMPORTS – Secex shows that, in December/21, Brazil imported 43.525 thousand tons, 16.4% up compared to the month before and an increase of 56.4% in relation to December/20. Import prices averaged 285.01 USD/ton (FOB origin), increases of 0.9% and 20.8% compared to November/21 and December/20, respectively.

UkrAgroConsult Raises Ukraine Corn Crop Estimate by 1.3M Tons

Ukraine’s 2021 corn harvest is now seen at 40.5m tons, up from a December estimate for 39.2m tons, based on the latest government yield data, according to a report form Kyiv-based researcher UkrAgroConsult.

- That could lift exports to 33.8m tons this season, versus 32.7m tons

- READ (Dec. 20): Ukraine’s Wheat Harvest Jumped 29.4% to 32.7M Tons in 2021

- NOTE: USDA is due to update its global grain supply, demand forecasts in a report on Wednesday

Vilsack Sets Goal of Doubling U.S. Cover Crop Acreage by 2030

U.S. Agriculture Secretary Tom Vilsack announces goal of doubling farm acres in U.S. with a cover crop to 30 million by 2030

- Also says U.S trade representatives will press China to make up a $16 billion shortfall in purchase commitments under the Phase One trade agreement “over the course of the next several years” and address remaining barriers to agricultural trade that Beijing agreed to lift

- Cover crops help sequester carbon in soil to reduce climate impact of farming

- USDA launches new initiative providing $38 million to encourage planting of cover crops in 11 states, including Arkansas, California, Colorado, Georgia, Iowa, Michigan, Mississippi, Ohio, Pennsylvania, South Carolina and South Dakota.

- U.S. had 900 million acres of farmland with 396 million used for crop production, according to the 2017 Census of Agriculture

- Vilsack spoke at the annual meeting of the American Farm Bureau Federation in Atlanta.

CPO PRICE SEEN REMAINING STRONG AT RM4,500-RM5,500 IN -JANUARY ON

KUALA LUMPUR, Jan 11 (Bernama) — CGS-CIMB is projecting the price of crude palm oil (CPO) to remain firm at RM4,500 – RM5,500 per tonne in January 2022, driven by tight near term global edible oil supplies and the labour shortage in Malaysia.

The research house is maintaining price forecasts of RM3,600 and RM3,240 per tonne for the full years of 2022 and 2023, respectively.

Malaysia Jan. 1-10 Palm Oil Exports to India 93,530 Tons: SGS

Following is a table of Malaysia’s palm oil export figures, according to estimates by independent cargo surveyor SGS Malaysia Sdn.

- India imported 93,530 tons; +26.3% m/m

- EU imported 67,290 tons; -41% m/m

- Turkey imported 29,235 tons; -66.2% m/m

China to Review Anti-Dumping, Anti-Subsidy Measures on U.S. DDGS

The existing anti-dumping and anti-subsidy measures on distiller’s dried grains produced by the U.S. will still be implemented while China reviews those measures from Jan. 12, according to China Mofcom. Those measures were adopted in 2017 and are scheduled to expire on Tuesday

China’s Blue-Sky Plan for Olympics Is Stifling Fertilizer Output

China’s urea plants are getting caught up in Beijing’s drive to ensure blue skies for the Winter Olympics, which includes ordering factory shutdowns to curb air pollution.

Three plants in northern Shanxi province were asked to begin operating at 50% capacity due to pollution, driving up domestic prices for the nitrogen fertilizer, said Scotiabank analyst Ben Isaacson. Futures in Zhengzhou rose almost 5% on Friday to the highest since October, but have pared gains this week.

As Beijing ramps up pollution controls in the lead up to the winter games in February, more urea factories could be asked to suspend or cut output. China, a key supplier of urea, sulphate and phosphate to the global market, has curbed fertilizer exports since late last year to protect domestic supplies, a move that worsened a global price shock and risked stoking food inflation further.

The outlook for urea is also dependent on the cost of energy sources like coal and natural gas, which have risen around the world due to shortages and winter heating needs.

U.S. Supreme Court leaves in place limits on higher-ethanol fuel blend

The U.S. Supreme Court on Monday turned away an industry group’s bid to revive a decision made by the Environmental Protection Agency under former President Donald Trump to allow expanded sales of gasoline that has a higher ethanol blend, called E15.

The action by the justices dealt a blow to the ethanol industry, which wants to increase sales and access to E15. Growth Energy, a biofuels industry group that had filed a petition asking the justices to review a lower court’s ruling vacating the Trump administration E15 policy, expressed disappointment in the Supreme Court’s decision.

“Growth Energy will continue to explore all potential avenues to make unfettered access to E15 a reality,” Emily Skor, the group’s chief executive, said in a statement.

The EPA in 2019 extended a waiver that allowed year-round sales of E15, effectively lifting summertime restrictions. Ruling in a lawsuit brought by an oil refining trade group challenging the policy, the U.S. Court of Appeals for the District of Columbia Circuit last year decided that the agency had exceeded its authority.

LATAM CROP WEATHER: Conditions to Improve for Soybeans Next Week

Dry and very warm conditions are expected for all of Argentina and southern Brazil in the coming days, before the arrival of beneficial precipitation next week, Don Keeney, a senior meteorologist at Maxar, said in an email.

- In Brazil, wetness will continue in northern Minas Gerais, northern Goias and Bahia states this week

- Weather pattern seen changing next week, resulting in wetter conditions in northern half of Argentina and southern Brazil, while northern Brazil will turn drier, Keeney says

- Dry conditions in Brazil’s north should favor soybean harvest, crop treatment

- “Conditions should improve in all of Brazil and northern Argentina” starting next week

- Southern Argentina will remain dry

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.