TODAY—NOPA MONTHLY CRUSH—COMMITMENT OF TRADERS—

Overnight trade has SRW Wheat up roughly 15 cents, HRW up 15; HRS Wheat up 10, Corn is down 1 cent; Soybeans down 9; Soymeal down $1.50, and Soyoil down 50 points.

For the week, SRW Wheat prices are up roughly 42 cents; HRW up 50; HRS up 40; Corn is up 74 cents; Soybeans up 52 cents; Soymeal up $24.00, and; Soyoil down 95 points. Crushing margins are down $0.03 at $0.68 (March); Oil share down 2% at 31%.

Chinese Ag futures (May) settled down 10 yuan in soybeans, up 6 in Corn, unchanged in Soymeal, down 108 in Soyoil, and down 148 in Palm Oil.

Malaysian palm oil prices were down 102 ringgit at 3,425 (basis March) on ideas of slipping exports.

In Brazil, conditions will still be very good in most areas. Some pockets of Rio Grande do Sul may become a little too dry occasionally; though, rain will occur often enough to prevent crop stress from becoming serious.

In Argentina, a meaningful and needed rain event will occur in much of the nation Friday through Saturday. An exception will be in La Pampa; though, some locally meaningful rainfall is occurring in this province this evening and tonight. A lengthy period of dryness will still follow the rain event leading to some increase of crop stress, especially in pockets of the region that miss out from getting much rain this week. Rain is still likely to return to Argentina in the last week of this month; though, confidence in the significance of this rain is also still low.

Argentine soy and corn fields have benefited from recent rains, with more showers expected that could slowly improve crop yields after they were threatened by dry weather earlier in the season, local climate experts said.

The player sheet had funds net buyers of 8,000 SRW Wheat; bought 30,000 Corn; net bought 18,000 Soybeans; bought 6,000 lots of Soymeal, and; bought 6,000 lots of Soyoil.

We estimate Managed Money net long 40,000 contracts of SRW Wheat; long 428,000 Corn; net long 236,000 Soybeans; net long 110,000 lots of Soymeal, and; long 111,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 7,100 contracts; HRW Wheat down 510; Corn up 8,300; Soybeans up 11,100 contracts; Soymeal up 640 lots, and; Soyoil up 755.

Deliveries were 94 Soymeal; 13 Soyoil; Rice 79; and 11 Soybeans.

There were changes in registrations (Soybeans down 3; Rice up 61)—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 169; Soyoil 1,289 lots; Soymeal 175; Rice 732; HRW Wheat 91, and; HRS 1,023.

Russia may impose a higher export tax on wheat from March 1, its economy minister said on Friday, in another push to curb domestic food price growth amid the COVID-19 crisis. A review by Moscow officials of previously approved state measures to slow food inflation has supported global wheat prices this week on expectations that the wheat of other countries would benefit from a higher Russian tax.

All U.S. Wheat sales up 8% vs a year ago; shipments down 1%; with the USDA forecasting a 2% increase.

By class, HRW sales up 1%, shipments up 3% (USDA up 5%)

SRW sales down 25%, shipments down 34% (down 18%)

HRS sales up 9%, shipments up 2% (up 1%)

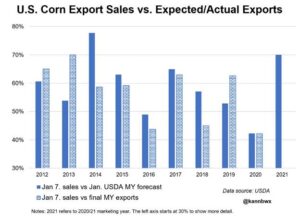

Corn sales up 135%, shipments up 77% with USDA up 43%

Soybean sales up 83%, shipments up 77% with USDA up 33%

Soymeal sales up 5%, shipments up 15% (up 1%)

Soyoil sales up 8%, shipments down 21% (down 3%)

NOPA December U.S. soy crush seen at 185.175 million bushels -survey – Reuters News

The U.S. soybean crush likely rose in December to the second-highest level on record for any month, capping the busiest year of processing ever for the industry

NOPA members were estimated to have crushed a near-record 185.175 million bushels of soybeans last month; if the average estimate is realized, it would be up 2.3% from November’s 181.018 million-bushel crush and up 5.9% from December 2019, when NOPA members processed 174.812 million bushels. It would also be just shy of the all-time monthly crush record of 185.245 million bushels, set in October 2020. December’s massive crush would take the annual soy processing volume among NOPA members above 2 billion bushels for the first time. The previous record annual crush in 2018 saw NOPA members handling 1.971 billion bushels. December crush estimates ranged from 182.000 million to 188.500 million bushels

The monthly NOPA report is scheduled for release at 11 a.m. CST (1700 GMT) on Friday.

Soyoil supplies among NOPA members at the end of December were seen rising for a third straight month to 1.712 billion pounds compared with 1.558 billion pounds at the end of November and 1.757 billion pounds at the end of December 2019. If realized, the stocks would be the largest in six months. Estimates for soyoil stocks ranged from 1.553 billion to 1.800 billion pounds.

Business for U.S. corn and soybean exporters has turned around drastically from last year’s dismal performance thanks to robust global demand, and the strong early sales paces have eased commitment pressure for the second half of the marketing year. The U.S. Department of Agriculture on Tuesday increased 2020-21 U.S. soybean exports by 30 million bushels to a record 2.23 billion bushels, a move traders largely expected based on strong sales and shipments.

The U.S. Environmental Protection Agency said on Thursday it would propose to extend deadlines for refiners to prove compliance with biofuel laws, but signaled it would not decide on a slew of pending waiver requests submitted by the industry. The agency’s proposal represented mixed news for refiners hard hit by slumping energy demand during the coronavirus pandemic and eager to sidestep regulatory costs associated with U.S. biofuel blending policy. It also marks one of the last actions from President Donald Trump’s EPA before he leaves office on Jan. 20. The agency said it is proposing to extend the compliance deadline for 2019 biofuel blending obligations to Nov. 30, 2021, and an associated deadline for submission of attest engagement reports to June 1, 2022. The EPA is also proposing to extend the 2020 deadlines to Jan. 31, 2022, and June 1, 2022.

The International Grains Council (IGC) on Thursday cut its forecast for a record global grains production by 9 million tonnes to 2.21 billion tonnes in 2020/21 and also trimmed its projection for consumption during the season.

In its monthly update, the inter-governmental body cut its forecast for corn (maize) by 13 million tonnes, partially offset by an upward revision in the outlook for wheat.

Global consumption of grains in 2020/21 was lowered by 5 million tonnes to 2.216 billion tonnes but remained above the prior season’s 2.192 billion. Grain stocks were seen dipping to a five-year low of 611 million tonnes.

The IGC cut its global corn production forecast by 13 million tonnes to 1.133 billion tonnes although it remained slightly up on the prior season’s 1.124 billion tonne crop.

The IGC raised its forecast for 2020/21 world wheat production by 3 million tonnes to 768 million tonnes with estimates for Australia, Canada and Russia all lifted. World wheat production in 2021/22 was seen rising by 3% to a record 791 million tonnes and consumption was also projected to climb by 3% to 775 million tonnes, also an all-time high. Harvested area was seen unchanged at a larger than average 223.9 million hectares with increases in Europe and the United States offset by declines in Australia, the Black Sea region and parts of Asia. The IGC said world wheat stocks were projected to rise by 15 million tonnes by the end of the 2021/22 season to a record high of 309 million tonnes.

Ukraine’s grain exports have fallen 18% to 27.2 million tonnes so far in the season, which runs from July 2020 to June 2021, economy ministry data showed. Traders sold only 12.7 million tonnes of wheat, 10.3 million tonnes of corn and 3.9 million tonnes of barley, the data showed.

The Indian government will hold new talks with the leaders of tens of thousands of farmers camped on the outskirts of New Delhi for almost two months protesting for the repeal of new agricultural laws they say threaten their livelihoods. Prime Minister Narendra Modi’s government has been urging the farmers to end their protest over the laws introduced in September, but the farmers say they will not relent on their demands, as the bills are designed to benefit private buyers at the expense of growers.

Malaysia’s palm oil exports during the Jan. 1-15 period are estimated to have fallen 44.4% on month to 403,255 metric tons, cargo surveyor SGS (Malaysia)

Exports of Malaysian palm oil products for January 1 – 15 fell 42.0 percent to 416,565 tonnes from 717,660 tonnes shipped during December 1 – 15, cargo surveyor Intertek Testing Services said on Friday.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.