TODAY—WEEKLY EXPORT SALES

Overnight trade has SRW down roughly 1 cent, HRW up 1; HRS Wheat down 1, Corn is up 3 cents; Soybeans up 3, Soymeal up $0.50, and Soyoil up 5 points.

Chinese Ag futures (Sep) settled down 2 yuan, up 17 in Corn, up 12 in Soymeal, up 38 in Soyoil, and up 62 in Palm Oil.

Malaysian palm oil prices were up 34 ringgit at 2,563 (basis October) at midsession, near 5 month highs, on lower output concerns.

U.S. Weather Forecast

Last evening’s GFS model run was notably drier in the eastern half of the Corn Belt July 25 – 27; the decrease was due to this evening’s run being too aggressive with a large ridge of high pressure shown to spread over much of the region.

Another notable change was the decrease of rainfall in the southern half of the Corn Belt July 28 – 30 and across the southeastern states as well.

The 11 to 16 day forecast has models back in agreement with a well defined ridge sitting over the Midwest bringing hot and dry weather.

The player sheet had funds net buyers of 17,000 contracts of SRW Wheat; were net even in Corn; bought 7,000 Soybeans; net bought 1,000 lots of soymeal, and; bought 3,000 Soyoil.

We estimate Managed Money net long 9,000 contracts of SRW Wheat; short 190,000 Corn; net long 90,000 Soybeans; net short 29,000 lots of Soymeal, and; long 17,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 3,200 contracts; HRW Wheat up 3,800; Corn up 19,500; Soybeans down 445 contracts; Soymeal up 3,200 lots, and; Soyoil down 4,200.

There were changes in registrations (Soyoil down 160; Rice up 163; HRW Wheat down 1)—Registrations total 95 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans ZERO; Soyoil 2,981 lots; Soymeal 511; Rice 260; HRW Wheat 47, and; HRS 1,387.

Tender Activity—S. Korea feed groups seek 55,000t optional-origin corn; passed on 69,000t; bought 130,000t optional-origin corn—

Wires report China’s U.S. farm product buying spree continued on Wednesday with private importers in the Asian nation booking more U.S. soybeans as the end of Brazil’s export season approached; private buyers booked at least five cargoes of U.S. soybeans on Wednesday, or at least 300,000 tons, for shipment mostly in October and November from Gulf Coast and Pacific Northwest ports.

China said it hopes the Phase 1 trade deal it reached with the United States can still be implemented and reiterated its willingness to stick to the agreement despite recent U.S. sanctions against Chinese officials and firms; Chinese foreign ministry spokeswoman Hua Chunying said that some in the United States were always oppressing and bullying China and said Beijing must act to reject and respond to such practices.

U.S. ethanol production for the week ended July 10th averaged 931,000 barrels per day (up 1.7% versus a week ago, down 12.7% versus a year ago); stocks totaled 20.6 mil barrels (down 0.6% versus a week ago, down 11.8% versus last year); corn use for the week was 93.3 mil bu (91.6 mil last week) and versus the 92.2 mil bu needed to meet USDA projections.

U.S. soybean crushings declined for a third straight month in June, but the 1.4% drop was smaller than expected and the total amount was the largest June crush on record; NOPA said its members, which handle about 95 percent of all soybeans crushed in the United States, processed 167.263 million bushels of soybeans last month, down from 169.584 million bushels in May but up from the 148.843 million bushels crushed in June 2019; analysts, on average, had been expecting a crush of 162.168 million bushels

Soyoil supplies among NOPA members at the end of June dropped by more than expected to 1.778 billion lbs, from 1.880 billion lbs at the end of May but up from 1.535 billion lbs at the end of June 2019; soyoil stocks, on average, had been expected to decline slightly to 1.813 billion lbs

Soymeal exports in June rose to 835,403 tons, from 776,677 tons in May and 554,867 tons in June 2019

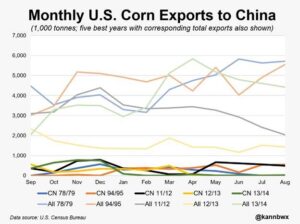

The new marketing year is still a month-and-a-half away, but the amount of new-crop U.S. corn that has already been sold to China would make those 2020-21 exports the second-largest on record if the full volume is shipped; the Phase 1 trade deal between Washington and Beijing essentially requires record exports of corn and other U.S. agricultural goods to China, something very much on the radar for corn with the way sales are going.

China’s pork output slides for 7th straight quarter in shadow of African swine fever.

The wholesale prices of China’s agricultural products edged down Thursday, according to the Ministry of Agriculture and Rural Affairs; the latest China agricultural product wholesale price index came in at 116.04, down 0.04 points from Wednesday; by 2 p.m. Thursday, the average wholesale price of pork, a staple meat in China, stayed relatively unchanged at 48.82 yuan (about 6.98 U.S. dollars) per kg, while eggs shed 0.9 percent to 6.57 yuan per kg; the average wholesale price of 28 key types of vegetables tracked by the government was up 1.7 percent from Wednesday, while six different types of fruits saw average price up by 2 percent.

Brazilian pork and chicken exports are projected to increase in 2020 as local meat producers have continued to operate virtually at a normal pace during the COVID-19 pandemic; pork exports can grow by as much as 33% to up to 1 million tons this year while chicken exports are increasing by up to 5% to 4.450 million tons, as demand from China remains strong.

A mild La Nina weather event is likely to hit Argentina in the final stretch of its wheat growing season, meteorologists said, extending a dry spell that has affected planting; a big part of Argentina’s wheat belt is already dryer than usual, with about 87% of the country’s 2020/21 crop having been planted so far and harvesting expected to start in December.

Argentina does not plan to increase grains export taxes despite the government’s need for revenue as the coronavirus pushes the country into a deep recession this year, the Agriculture Minister said; farmers in the vast Pampas grains belt had worried that the cash-strapped government, embroiled in a complicated restructuring of $65 billion in sovereign bonds, might raise taxes on international shipments of wheat, corn and soy.

Germany’s 2020 soft wheat production is set to fall by 6% compared with last year to 21.6 million tons, dented by a sharp drop in sowing during a wet autumn, consultancy Agritel forecasted; the decline in winter wheat sowing last autumn was expected to outweigh a slight increase in average yield; that decline also outweighed an increase in area for Germany’s much smaller spring wheat production.

Dutch nutrition company Royal DSM and French agri-food group Avril said they would start production of rapeseed (canola)-based protein for the food industry as of 2022 as they aim to benefit from the booming plant-protein market.

India’s soybean production is set to jump by at least 15% in 2020 from a year earlier as farmers are increasing the oilseed’s acreage due to timely arrival of monsoon rains and as New Delhi raised the minimum buying price; increased production of India’s main summer-sown oilseed could help the world’s biggest vegetable oil importer trim costly purchases of palm oil, soyoil and sunflower oil from Indonesia, Malaysia, Argentina and Ukraine; it could also revive Indian exports of animal feed ingredient soymeal to places such as Bangladesh, Japan, Vietnam and Iran.

The world’s second largest palm oil producer Malaysia has estimated its total palm oil export value this year at 65-70 billion ringgit ($15.24 billion-$16.41 billion), the Plantation Industries and Commodities Ministry said; this is up from 63.73 billion ringgit in palm oil exports achieved last year.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.