USDA WASDE PRODUCTION HIGHLIGHTS

Disappointing trade action despite somewhat supportive numbers. Agricultural markets remain more focused on favorable US weather while bracing for higher production in future reports.

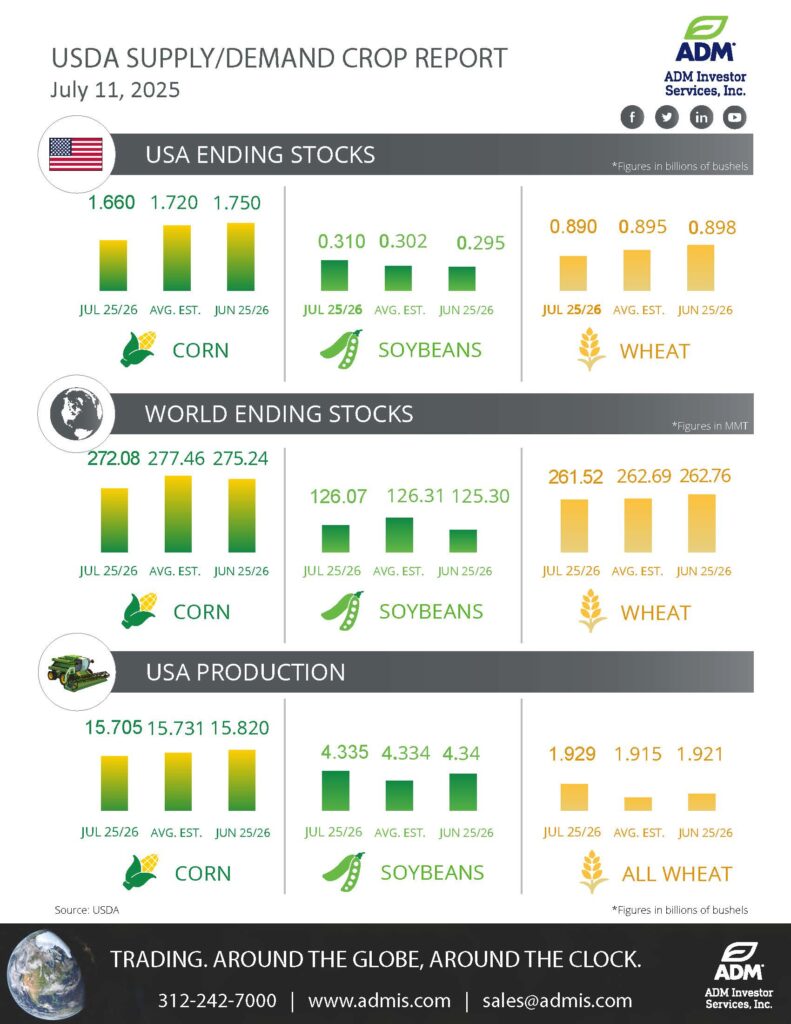

Corn:

- 2024/25 ending stocks down 25 mil. bu. to 1.340 bil. exports up 100 mil. feed usage down 75

- 2025 production 15.705 bil., down 115 mil. on lower harvested acres

- 2025 yield left unchanged at record 181 bpa

- New crop usage cut 50 mil. bu. on lower feed demand, exports left unchanged at 2.675 bil.

- 2025/26 Ending stocks down 90 mil. to 1.660 bil., 60 mil. below expectations

- Brazil’s 2024/25 production raised 2 mmt to 132 mmt, at the low end of expectations

- 2025/26 global stocks at 272 mmt, down 3.2 mmt, well below expectations

Soybeans

- 2024/25 ending stocks unchanged at 350 mil. bu. slightly below expectations

- 2025 production 4.335 bil., down 5 mil. on lower harvested acres

- 2025 yield left unchanged at record 52.5 bpa

- New crop usage cut 20 mil. bu., crush increased 50 mil., exports cut 70 mil.

- 2025/26 Ending stocks up 15 mil. to 310 bil., slightly above expectations

- Bean oil usage for biofuel production cut 650 mil. lbs. for 24/25 MY, up 1.6 bil. lbs. 25/26 MY

- Bean oil exports 25/26 MY slashed 1 bil. lbs. to 700 mil. lbs.

- 2025/26 global stocks at 272 mmt, down 3.2 mmt, well below expectations

Wheat

- All wheat production at 1.929 bil. up 8 mil. and 15 mil. above expectations

- Winter production at 1.345 bil. down 37 mil., 17 mil. below expectations

- HRW down 28 mil. to 755 mil. SRW down 8 to 337 mil.

- Spring wheat production at 504 mil. down 38 mil. from YA, 30 mil. above expectations

- 2025/26 ending stocks at 890 mil. bu. slightly below expectations

- 2025/26 exports raised 25 mil.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.