MORNING LIVESTOCK FUTURES OUTLOOK

CATTLE COMPLEX

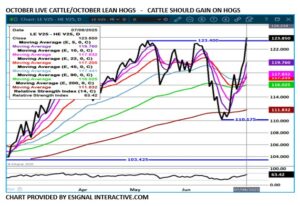

New contract highs with new contract high closes were made for live cattle and feeder cattle Tuesday. Live cattle trade volume was active with traders buying futures and actively bull spreading. Throughout 2025 bull spreads indicated the strength in the cattle market.

Trade volume was extremely heavy. June volume was 63,368, October 43,197 and December 24,890. The heavy trade volume Tuesday and bull spreading strongly suggest that funds were coming back for the 3rd quarter and 2nd half of the year.

PORK COMPLEX

The difference between the CME Lean Hog Index and the CME Pork Cutout at $4.07 puts packers deep in the red. Packers will kill enough hogs to fill previously contracted pork orders.

Tariff negotiations especially for China , Brazil, Japan and South Korea will be important to watch.

>Read full report here.

Interested in more futures markets? Explore our Market Dashboards here

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.