Soybeans, soymeal, soyoil, corn and wheat traded lower. Could be some long liquidation before month end and US elections. US stocks were mixed to lower. US Dollar was lower. Crude was higher.

SOYBEANS

Managed funds are net sold 2,000 soybeans, 4,000 soymeal and 2,000 soyoil. We estimate Managed funds are net long 251,000 soybeans, 94,000 soymeal and 88,000 soyoil. US soybean harvest is 85 pct done versus 57 last year. US soybean exports to date are near 14.3 mmt versus 8.0 last year. USDA goal is 59.8 mmt versus 45.6 last year. There were no new US soybean sales announced today. Tight old crop supplies has Brazil out of the soybean, soymeal and soyoil market. Some feel BOZ could trend higher due to higher World vegoil prices led by palmoil and sunoil.

CORN

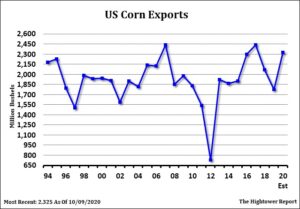

Corn futures traded lower. Despite tight US supplies and increase demand for exports, there may have been some long liquidation before month end and US elections. USDA estimated US corn harvest at 72 pct versus 60 last week, 56 average and 38 last year. US farmer is selling some corn but a higher pct than normal is going to storage. US corn exports to date are near 6.1 mmt versus 3.4 last year. USDA goal is 59.0 mmt versus 45.1 last year. US corn export and domestic market needs to buy more corn. Commercial are still looking at higher demand for US corn exports than USDA guess and well above last year. USDA estimate of Ukraine corn crop could be 6 mmt to high. EU may need to find 18-20 mmt feed grain imports. Goldman Sachs sees a structural bull market for commodities emerging in 2021 as nearly all raw materials are moving toward deficits as inventories are drawn down. Three main drivers for the emerging bull market are structural under-investment in the old economy, policy driven demand and macro tailwinds from a weakening dollar and rising inflation risks. Managed funds bought 2,000 corn. We estimate Managed funds are net long 251,000 corn. Brazil has rain falling in most of the nation at one time or another, but rainfall will be least frequent and least significant in the interior south. Argentina will receive showers today and Wednesday before dry weather occurs for about a week.

WHEAT

On again off again wheat trade was back off again today. Talk of some fund long liquidation before month end and US elections may have weighed on wheat futures. Recent improvement in rains in US south plains and Russia limited the upside in futures. Quick advancement of EU wheat plantings weighed on Matif French wheat futures. 85 pct of US winter wheat crop is planted. USDA estimated that 41 pct of the US 2021 winter wheat crop was rated good/ex. This was well below the trade guess and last year. Kansas is 29. OK is rated only 11 pct good. TX is 37 G/E. CO is 24. MO IS 49. MI is 71. OH is 68. IL is 68. WA is 73. Significant precipitation is still expected in West Texas and from the Texas Panhandle through Oklahoma and south-central Kansas tonight into Thursday. This will significantly increase soil moisture and be beneficial for newly planted winter crops. US Midwest 6-10 day and 8-14 day weather forecast suggest normal to above temps and normal to below rains. US wheat exports to date are near 11.0 mmt versus 10.6 last year. USDA goal is 26.5 mmt versus 26.3 last year with the USDA currently forecasting a 1% increase on the year.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.