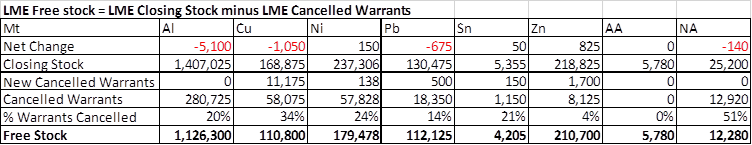

LME Aluminium Stocks and Klang:

Last week’s announcement of a COVID-19 shutdown in several Malaysian regions including Klang, their busiest port, which got the LME pretty excited and caused a spike in nearby aluminium spreads.

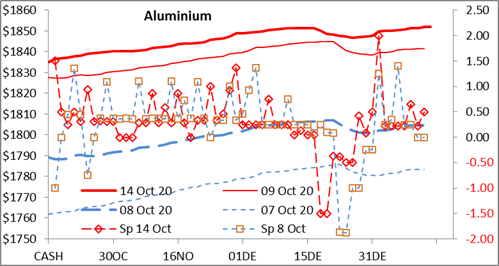

The chart (Source: LME /Reuters/ADMISI) shows LME Aluminium daily curves on 7th, 8th, 9th and 14th Oct, together with the intra-day spreads on 8th Oct and 14th Oct.

Basis PM vals, the nearby backwardation was most pronounced on Thursday 8th, feeding into Friday morning with Tom-Next trading out to $9 back.

Later on Friday the Malaysian Govt announced that the COVID measures would not impact economic activity at the port, and spreads eased off by Friday’s close.

The market’s faith in their ability to keep the port running was repaid this week, with stock figures showing net aluminium outages at Klang of 2500mt/day to 6300mt/day so far.

Klang has been the feature location for aluminium stocks since heavy cancelations in early 2019 started a modest warehouse queue at a level economic under the LME’s Queue Based Rent Capping (QBRC).

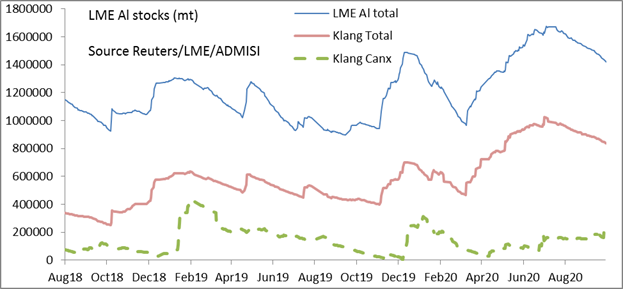

The chart shows LME Aluminium Total Stocks, and Klang Aluminium Total and Klang Cancelled Aluminium

Since 2019, Klang has held 40%-63% of total LME aluminium stock and has seen up to 76% of cancelled LME aluminium stock.

The Klang queue is very modest compared to the >2yr queues seen at Detroit and Vlissingen in 2013-2014, before the LME introduced the QBRC.

Under the QBRC, the allowable rent was 40days (30days full rent and 20days half rent), but a scale up relaxation of the QBRC for 2020 was announced in 2019, with maximum chargeable rent being 50 days from Feb 2020, 60 days from May 2020, 70 days from Aug 2020 and 80 days from Nov 2020.

The calculations have changed since aluminium queues were really large but, with Klang holding 875kmt, the average minimum loadout should be 3500mt per working day (for 600-900kmt warehouse stock), suggesting an 80 calendar day queue is approx. 200kmt canx.

To view the full LME Stocks Report and to subscribe to this daily report:

Email: metals.desk@admisi.com

Phone: +44 (0) 20 7716 8610

© 2020 COPYRIGHT ADM INVESTOR SERVICES INTERNATIONAL LIMITED – ALL RIGHTS RESERVED

ADM Investor Services International Limited is authorised and regulated by The Financial Conduct Authority. Member of The London Stock Exchange. Registered office: 4th Floor Millennium Bridge House, 2 Lambeth Hill, London EC4V 3TT. Registered in England No. 2547805 a subsidiary of Archer Daniels Midland Company. Risk Warning: Investments in Equities, CFDs, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value, investors should therefore be aware that they may not realise the initial amount invested, and indeed may incur additional liabilities. These Investments may entail above average financial risk of loss, and investors should therefore carefully consider whether their financial circumstances and investment experience permit them to invest and, if necessary, seek the advice of an independent Financial Advisor. Some services described are not available to certain customers due to regulatory constraints either in the United Kingdom or elsewhere.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.