- Manufacturing PMIs in focus on busy day for statistics and central bank speakers; better than expected Japan CapEx, slide in Korean Exports, German Retail Sales and UK Nationwide House Prices to digest; US Personal Income, PCE, Construction Spending and Auto Sales, Brazil Q3 GDP ahead

- Manufacturing PMIs/ISM: weakness seen pervasive outside of India and a few parts of SE Asia; US ISM expected to drop into contraction territory for the first time in 30 months

- Powell post mortem: slower pace of hikes signalled, but already heavily discounted in markets, but distinctly less hawkish, and not dovish

- US Personal Income/PCE: Spending expected to be robust, deflators seen signalling slower fall than CPI; potential reality check for market rate trajectory

EVENTS PREVIEW

The final month of another very tempestuous year gets underway, with Manufacturing PMIs/ISM dominating the schedule, though there is plenty more with Australian (missing forecasts) and Japan’s Q3 CapEx (much better than expected, and implying smaller contraction in Q3 GDP), Korean Trade (exports sliding more than forecast), Indonesia CPI; German Retail Sales and UK Nationwide House Prices to digest, the latter two also turning out much weaker than forecast. Ahead lie Eurozone Unemployment, Brazil Q3 GDP, US Personal Income & PCE, weekly Jobless Claims, Auto Sales and Construction Spending. There are plenty of BoJ, ECB and Fed speakers, and a meeting of the OSCE that will focus on Russia’s invasion of Ukraine. Govt bond supply is plentiful with Spain and France holding multi-maturity sales and the UK 30-yr. While markets jumped on Powell’s comments, the key point from Powell’s speech was that it is an open question as to “how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level”, the point being that the message was ‘less hawkish’, but absolutely not ‘dovish’.

** World – November Manufacturing PMIs/ISM **

As was evident in the flash PMIs, the manufacturing sector in the western world has slipped into contraction, and while some of this is due to improving supplier deliveries and some easing of input costs, Orders and Output metrics are in contraction, or have slowed considerably. For all that India and parts of East Asia are clearly holding up relatively well, this is largely rendered moot by the ongoing problems in China, with the marginal rebound in the PMI hardly signalling the start of a more robust upturn. The primary focus will be on the US Manufacturing ISM, which is forecast to dip to 49.7 from October’s 50.2, the first sub 50.0 reading since May 2020.

** U.S.A. – October Personal Income/PCE, Jobless Claims and Nov Auto Sales **

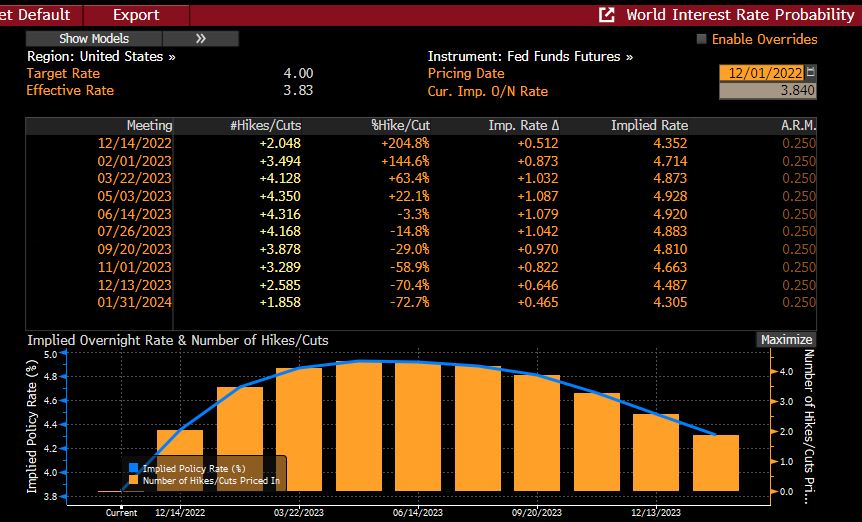

For all of the recession chatter in the US, today’s Personal Income and PCE report is unlikely to offer much in the way of support, and the deflators are expected to serve as a reminder that the much better than expected CPI data was perhaps not as strong a signal that inflation is decelerating. Personal Income is seen up just 0.2% m/m, rather weaker than the average earnings print in the labour report, with weakness in farm sector payments acting as a restraint; PCE is however expected to echo Retail Sales with a very solid 0.8% m/m increase. As previously noted, OER and Medical Insurance were key factors in the softer CPI data, but these have a smaller weighting in the PCE deflators, with the consensus looking for a 0.4% m/m 6.0% y/y headline increase (vs. September 6.2%), while core is seen posting a 0.3% m/m increase to leave the y/y rate 0.1 ppt lower at 5.0%. Given Powell’s hints about moderating the pace of rate hikes yesterday, the outcome is to a certain extent moot, though a higher than expected outturn would beg the question about whether markets have already more than discounted a gentler rate trajectory, and serve as a reminder that while inflation is going to come down, a return to 2.0%-3.0% before Q1 2024 will require energy prices to remain at current or lower levels, and core services pressures to ease significantly. Given that markets are now pricing a peak of 4.92% for Fed rates as against 5.05% ahead of Powell’s speech, there is some risk that they have got ahead of themselves, even if poor underlying market liquidity will continue to exaggerate the scale of any moves in rate expectations or other asset prices.

Table: Fed rate expectations by meeting

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.