- Flash PMIs top busy day for statistics, digesting Japan CPI, UK Retail Sales & GfK Consumer Confidence, Korea Exports; Canada Retail Sales, more central bank speakers, broad sectoral mix of US Q1 earnings

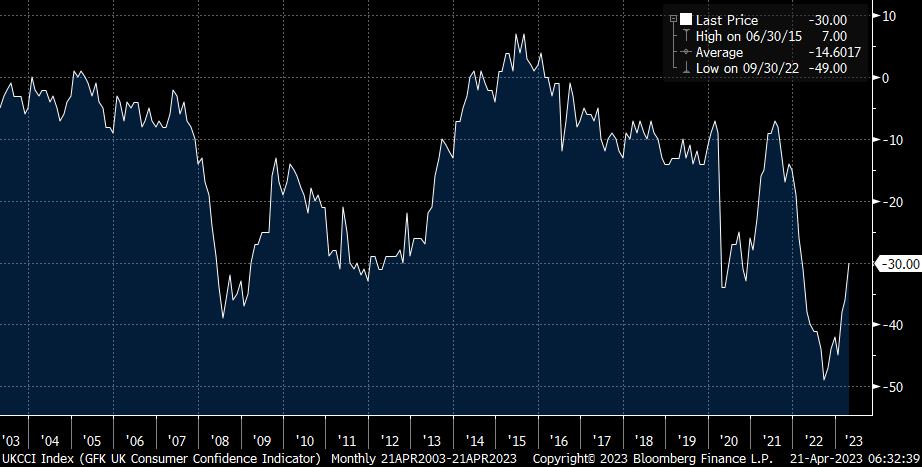

- UK Gfk Confidence continues solid recovery, but still depressed on any historical comparison

- UK Retail Sales drop more a case of mean reversion after exaggerated strength in January and February, and still up for Q1 overall

- PMIs likely to confirm established picture: manufacturing contracting while Services continue to see solid expansion

EVENTS PREVIEW

A busy day for statistics to end the week with Japan’s National CPI, UK GfK Consumer Confidence and Retail Sales along with South Korea’s April 1-20 Exports to digest, but the focus will be on G7 flash PMIs, which are accompanied by Canadian Retail Sales. There is a smattering of Fed and ECB speakers, and the hardly diplomatic comments from BoE’s soon departing Tenreyro likening hawkish members of the MPC to Milton Friedman’s “fool in the shower”. Italy will sell 2-yr and inflation-linked 5-yr. On the earnings front, Great Wall Motor and SAP will be among the headline makers, while the US eyes Freeport-McMoRan, HCA Healthcare, Procter & Gamble and Schlumberger, though the dramas around Tesla, SpaceX and Twitter over the past 48 hours may be the bigger discussion point for markets’ chattering classes.

Next week’s schedule has a lot of major data, including advance Q1 GDP readings for the US, South Korea and many EU countries, which also have provisional April CPI readings for April, as well as a raft of surveys including Germany’s Ifo and GfK. The US will also look to Personal Income/PCE, Durable Goods Orders, Consumer Confidence, House Prices, Goods Trade Balance, Pending Home Sales and more regional Fed surveys. While Japan has its usual end of month Tokyo CPI, Industrial Production and Retail Sales, all eyes will be on the BoJ policy meeting which concludes on Friday. New governor Ueda has been at pains to signal that there will be no change in policy at that meeting, but markets remain understandably very wary about any signals on a potential future shift from its ultra-accommodative policy stance, even more so after the March ‘core core’ CPI was higher than expected at 3.8%, and at its highest y/y level since 1981.

** U.K. – April GfK Consumer Confidence & March Retail Sales **

GfK Consumer Confidence continued its relatively sharp recovery, with a third consecutive rise to -30 from -36, paced both by improving views about Personal Finances and the Economic Situation, and somewhat less by the Climate for Major Purchases (-28 vs. -33). But as the attached chart highlights, it is still only modestly above pandemic and GFC lows, though the trend is clearly one of solid improvement. Retail Sales were a little weaker than expected falling 0.9% m/m -3.1% y/y, and effectively correcting the exaggerated strength of January and February, but nevertheless still expanding overall in Q1.

** G7 – April ‘flash’ PMIs **

G7 PMIs are expected to confirm established trends for manufacturing (contracting) and Services (expanding at a healthy if not robust pace), with UK and Eurozone Manufacturing improving fractionally, while the US is seen easing marginally; and Services easing relative to February across the board, but more sharply in the US. There will inevitably be one or more surprises, but it will be the details on Orders and Output, and Services’ New Business which should attract most attention.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.