- Busier run of data as markets tentatively stabilize: focus on PMIs, UK GfK survey and Retail Sales, US Durable Goods, Brazil IPCA-15 inflation and Canada Retail Sales; ECB, Fed and BoE speakers

- UK: GfK picks up, but more a case of less pessimism than optimism, Retail Sales strength underlines resilience message, though discount store strength highlight ongoing cost of living challenges

- US Durable Goods seen posting marginal gain, as businesses remain cautious on CapEx outlook

- USA: high level of Fed discount window borrowing, jump in BFTP usage reverses much of Fed QT, underlines fragility and counterparty risk concerns

EVENTS PREVIEW

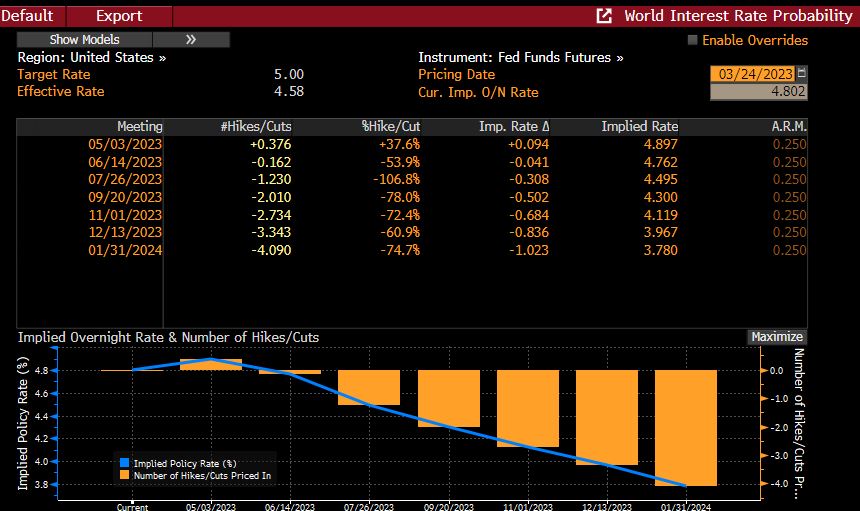

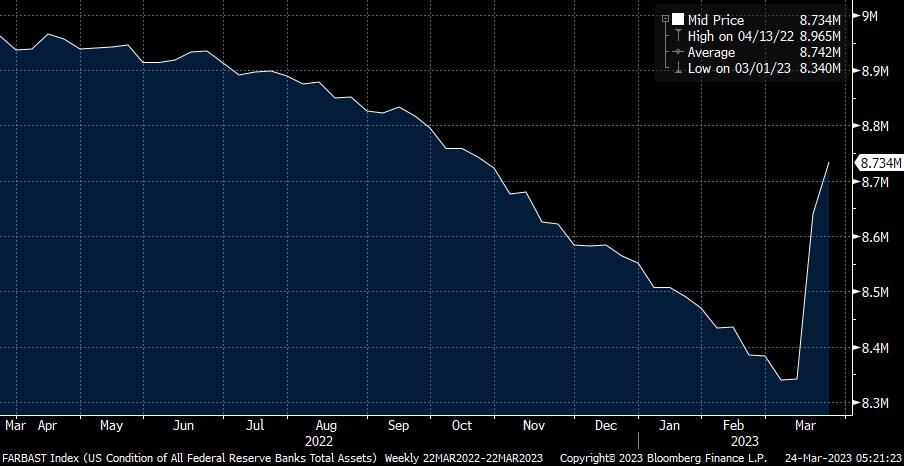

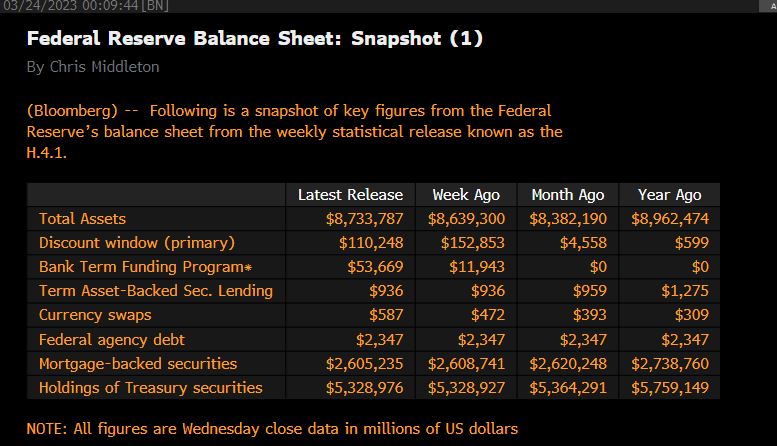

The week ends with a relatively busy schedule of statistics, with G7 ‘flash’ PMIs, UK GfK Consumer Confidence and Retail Sales and US Durable Goods Orders providing the headlights, while a gaggle of ECB, Fed and BoE speakers feature on the events schedule. In terms of the latter the focus will be on their messaging in the wake of all delivering expected rate hikes, seemingly confirming that they see no trade-off between fighting inflation and financial stability concerns. But market rate expectations have shifted sharply, with the Fed now expected to have cut rates by nearly 100 bps by the end of 2023, the ECB seen hiking rates just once more this year, while the BoE is expected to hike rates once more, but to reverse this by year end (see charts). A degree of calm has returned to equity markets, while the widening in credit spreads has been halted, but remains substantially wider than prior to the SVB collapse – per se risk appetite has stabilized, in no small part helped by Fed liquidity provisioning. Yesterday’s weekly Fed Balance Sheet report (see table and chart) saw a further rebound of $100Bbln, bringing the total increase in the past fortnight to $400 Bln, in effect reversing 60% of the QT reduction. In the detail, the take-up of the Bank Term Funding Program rose sharply to $53.66 Bln vs prior week $11.9 Bln, and mirrored effectively by a $42 Bln reduction in Discount Window borrowing, though this remains very high at $110.2 Bln (vs. just 4.6 Bln a month ago). It is worth noting that for all the volatility above all in rates, that there has been, overall US financial conditions have in fact been entrenched in a well-defined range (see chart) since the end of November, underlining that this has not been a broad systemic crisis, but rather a shift in where assets are held, with money market funds and GSIBs seeing substantial inflows, while regional banks witnessed outflows; counterparty risk remains high on agenda. It should be added that flows are one thing, but do not offer any specific detail on how much lending standards have tightened. On balance, it remains the case that overall excess liquidity remains high, but market liquidity remains thin, and volatility on a knife edge, i.e. still just another negative headline or rumour away from a reignition of fear.

G7 flash PMIs are forecast to see a modest improvement in Manufacturing, albeit still mostly contracting, and a slight setback in most Services readings after some modest strength in February. Much may depend on data collection timing, given some risk of contagion effects to non-financial sentiment from the ‘banking crisis’. Prices sub-indices will require particular monitoring, given the easing in both oil and gas prices.

U.K. data overnight saw an as expected pick-up in Gfk Consumer Confidence to a still very down at heel -36 from -38, paced by economy expectations (-62 vs. -65) and Major Purchases Climate (-33 vs. -37), though notably seeing a renewed dip in Personal Finances Expectations (-21 vs. -18). By contrast Retail Sales were much stronger than expected at 1.2% m/m, with an upward revision to January to 0.9% from 0.5%, with notable strength in Food (0.9% m/m), Non-specialized Stores (5.5% m/m, boosted above all by Discount Stores) and a 2.9% m/m rebound in Clothing & Footwear. As with the US, UK consumer spending is showing some resilience despite cost of living pressures, though the strength in discount store sales underlines that challenges clearly remain.

US Durable Goods Orders are forecast to rise a tepid 0.2% m/m both on headline and the core CapEx proxy Non-defence Capital Goods ex Aircraft, the latter slowing from 0.8% in January, and predicated on ISM Manufacturing Orders (47.0 vs. Jan 42.8) remaining weak, and suggesting unsurprising caution on the sector CapEx outlook. But with banking concerns still very much at the forefront of market concerns, this will have to spring a surprise to have anything more than a passing impact.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.