- Mega tech and other US earnings likely front and centre; digesting South Korea GDP and UK PSNB; awaiting UK CBI Industrial Trends, US Consumer Confidence, House Prices, New Home Sales; Hungary rate decision, SARB policy review, ECB and BoE speakers; German and US 2-yr auctions

- US Consumer Confidence seen little changed, Services PMI imparts some upside risk, but softer labour demand may drag

- US New Home Sales seen reversing some of prior 3 months rebound, higher mortgage rates and affordability headwinds

EVENTS PREVIEW

While the statistical run has rather more meat on the bone today, it is likely to be subordinate to the run of US Q1 earnings, which features a broad sectoral array of major US corporates. There are South Korean Q1 GDP (as expected) and UK PSNB budget data (marginally better than forecast) to digest, with the CBI Industrial Trends survey ahead (quite possibly the last of any significance, given the scandal engulfing organization probably did not affect the number of responses this month). The US looks to Consumer Confidence, FHFA and CoreLogic CS House Prices, New Home Sales, and Richmond and Dallas Fed surveys. BoE’s Broadbent and ECB’s de Cos are the day’s central bank speakers, with Hungary’s MNB seen holding rates at 13.0%, while South Africa’s SARB publishes its biannual Monetary Policy Review. Alphabet and Microsoft offer the first of this week’s US ‘Megatech’ earnings reports, while other likely headline makers include: 3M, ADM, Dow, General Motors, Halliburton, McDonald’s, PepsiCo, PulteGroup, Raytheon, Texas Instruments, UPS, Verizon and Visa. Govt bond supply takes the form of 2-yr auctions in Germany and the USA.

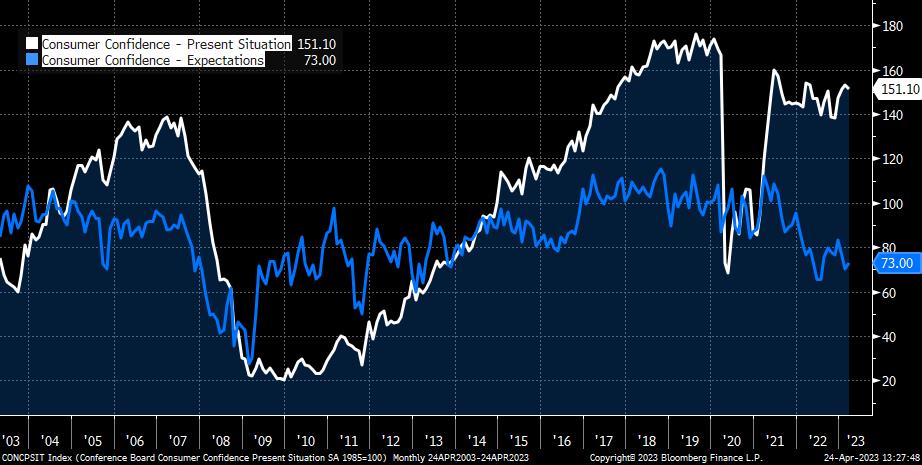

** U.S.A. – Apr Consumer Confidence,, Mar New Home Sales & Feb House Prices **

– Consumer Confidence is seen little changed at 104.0 (vs. March 104.2), some loosening in labour market conditions suggests some downside risks, on the other hand the flash PMIs (above all Services) showed some resilience. What remains very notable is that Expectations remain very depressed (even lower than the Pandemic low), despite the continued buoyancy of the Present Situation Index, and a still very robust Labour Market differential (jobs ‘plentiful’ minus ‘hard to get’). Both FHFA and CoreLogic House Prices are expected to drop again in m/m terms, which would take the CoreLogic measure just into negative territory at -0.1% y/y. New Home Sales are seen dropping 1.6% m/m after 3 months of solid gains, with higher mortgage rates and persistent affordability challenges continuing to present considerable headwinds, even if the slide in the housing market does look as though it is bottoming out.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.