China inflation data tops modest run of data, as focus remains on next week’s central bank event risk and busy run of major data; smattering of ECB speakers

China CPI and PPI: m/m changes underscore deflationary pressures, likely fuel rate cut speculation, but fiscal measures needed to address scale of underlying issues

Market messaging dissonant; low volatility a case of calm before the storm?

EVENTS PREVIEW

Today’s schedule of data has some significant items, via way of the overnight China CPI & PPI, weak Swedish monthly GDP, higher than expected Norwegian CPI, with Italian Industrial Production and Canadian labour data ahead. But given an event risk heavy week ahead, today’s run which also has a few ECB speakers may end up being just so much water under the bridge, though agricultural commodity markets will be very much focussed on the monthly USDA WASDE report, which follows on from China’s Agriculture Ministry CASDE overnight. Next week brings the Fed, ECB and BoJ policy meetings, which accompany a very busy data run from US (CPI, Retail Sales, PPI, Industrial Production, NY & Philly Fed Manufacturing and Michigan Sentiment surveys), China (Retail Sales, FAI, Industrial Production & Property sector indicators), and UK (labour data, monthly GDP & activity data). Elsewhere there are final CPI readings in the Eurozone, along with German ZEW survey, Australia has labour data, and Japan looks to Trade and Machinery Orders. It remains the case that ‘market signals’ are very dissonant, with the S&P 500 yesterday entering a bull market, while interest rate markets, buffeted by the RBA and BoC rate hikes this week, and continuing to price in a Fed rate hike in July, but looking for a rate cut in Q4. It attests both to the overhang of excess central bank liquidity, at the same time as market liquidity conditions continue to deteriorate, and likely signals that the current period of low volatility, above all in equities, may prove to be the calm before the storm.

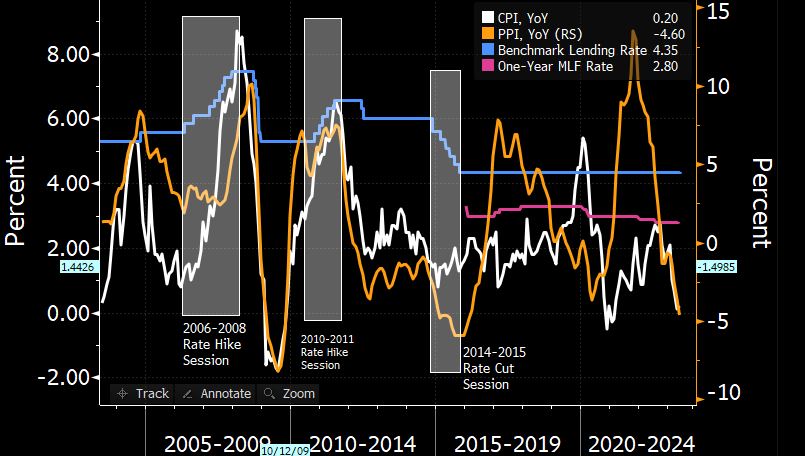

** China – May CPI & PPI **

The extent of the deflationary forces at work in China was above all evident in the m/m reading for PPI at -0.9% m/m and CPI at -0.2% m/m, which translate to y/y readings of PPI -4.6% y/y and CPI at 0.2%, the latter only edging up from 0.1% thanks to Food CPI base effects (1.0% y/y vs. April 0.2%), though Food PPI decelerated sharply to 0.2% y/y from 1.0%. The data has unsurprisingly fuelled expectations of a rate cut at next week’s 1-yr MTLF operation and the week after’s monthly Loan Prime Rate fixings, with major banks having already cut deposit rates. But as the example of the Eurozone during the previous decade amply demonstrates, all too often this leads to consumers doubling down on saving, rather than encouraging spending. Without major fiscal stimulus, which China’s authorities are clearly reticent to implement due to already dangerously high municipal debt levels, as well as fear of fuelling a speculative wave in its financial markets, a 5-10 bps cut in rates is likely to achieve little, above all in the absence of measures to a) cut Youth Unemployment that stands above 20%, and b) a more forceful approach to balance sheet reconciliation in the still very beleaguered property sector.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.