Written by Marc Ostwald, ADMISI’s Global Strategist & Chief Economist

The new week sees a busier run of US statistics (Consumer Confidence, Durable Goods, Auto Sales, House Prices, revised Q4 GDP and above all Personal Income & PCE), Eurozone provisional CPI and M3, German Unemployment, Japan’s national CPI, Retail Sales and Industrial Production, China’s official NBS PMIs and Manufacturing PMIs worldwide, UK BRC Shop Prices and credit aggregates, Indian Q4 GDP, Australian CPI and South Korean Trade. It also has another busy run of central bank speakers, with rate decisions due in New Zealand (unchanged 5.50%), Hungary (100 bps cut to 9.0%), Israel (25 bps cut to 4.25%) and Nigeria (250 bps hike to 21.025). In the commodity space, earnings from the likes of Canadian Natural Resources, Eni, Pemex, Sasol and Uniper accompany London International Energy Week and Nigeria International Energy Summit conferences; the agricultural sector looks to USDA crop progress reports, EU MARS Crop Bulletin, Prague Black Sea Grain Conference and earnings from Golden Agri-Resources and Olam Group, while Metals eye earnings from Lynas and Sibanye Stillwater. Govt bond supply sees the US sell $169 Bln of 2, 5 & 7-yr, Germany offering 14, 18 & 26-yr, the UK 6-yr & I-L 15-yr, the usual end of month auction of Italian 5 & 10-yr, while the Netherlands offers 20-yr. The US corporate earnings season winds down with the focus on more retailer reports, but there is a busy schedule of earnings elsewhere, including the full roster of Canadian banks. Saturday very sadly marked the second anniversary of the Russian invasion of Ukraine, with the EU struggling to meet its defence commitments to Ukraine, and US military aid for Ukraine stuck in a very polarised Congress, which will also need to pass a funding bill by Friday to avert a partial US government shutdown on March 1, and a much broader shutdown a week later.

Statistically, the focal point for the US will be Friday’s PCE deflators, that are expected to echo CPI with increases of 0.3% m/m headline and 0.4% m/m on core, which thanks to base effects will still see y/y rates to fall to 2.4% and 2.8% respectively, and likely to continue to head slowly lower in coming months, even if 3 6-mth annualized rates tick higher short-term, and leaving the door open to an initial rate cut in June. New Home Sales get the week underway, and are seen up a further 3.0% m/m following December’s 8.0% rebound, with Pending Home Sales later in the week also expected to post a gain of 1.1%, while FHFA and CS CoreLogic House Prices (for December) are seen up 0.3% and 0.2% m/m to push the latter’s y/y rate up to 6.0%, remarkable given the rise in mortgage rates. Consumer Confidence on Tuesday is seen edging up to 115.0 after January’s unexpectedly strong rise to 114.8 from 108.0, with robust labour demand underpinning the current strength, as was so evident in January’s sharp Labour Differential rebound (see chart).

Headline Durable Goods Orders are forecast to take a big hit (exp. -5.0% m/m) from very weak Boeing orders, but are seen up 0.2% m/m ex-Transport and 0.1% m/m on the core Non-defence Capital Goods ex-Aircraft metric. The first revision to Q4 GDP is expected to show headline unchanged at a robust 3.3% SAAR, but Personal Consumption shaded 0.1 ppt lower to 2.7%, but this is now very historical. The advance Goods Trade Balance, Dallas, KC and Richmond Fed and final Michigan Sentiment surveys are also tabled for release.

In the Eurozone, provisional February CPI will be the headline item, with base effects more than offsetting an expected and seasonally typical large m/m rise of 0.6%, taking the headline y/y rate down to 2.5% from 2.8%, and core to 2.9% y/y from 3.3%, the lowest reading since March 2022; with the exception of Italy (but still the lowest at 1.0% y/y), other national readings are all set to fall. German Unemployment is expected to rise a modest 5K to leave the Unemployment Rate unchanged at 5.8%, while French and German Consumer Confidence are seen improving slightly, but remaining low on historical comparisons, as are the EC Confidence metrics, while French Consumer Spending is forecast to ease back -0.2% m/m. In the UK, BRC Shop Prices are anticipated to drop again to 2.5% y/y, the lowest level since March 2022, but while this goods price disinflation is welcome (above all food), it is the trend in sticky Services inflation which remains key to the BoE rate outlook. The Lloyds Business Barometer will bear some scrutiny, with the headline (last 44) and Business Expectations (last 51) close to longer-term peaks, echoing the recent strength seen in the Services PMIs. Credit aggregates are expected to show Consumer Credit picking up to £1.5 Bln, thus keeping close to longer term trends, as are Mortgage Approvals (exp. 52K) and Net Lending Secured on Dwellings (£200 Mln vs. prior £-800 Mln), but still depressed on any historical comparison. Nevertheless, Friday’s Nationwide House Prices are seen up 0.3% m/m to register a y/y gain of 0.7% y/y, the first annual increase since January 2023.

Over in Asia, China’s official NBS PMIs are expected to be little changed at 49.1 Manufacturing and 50.8 Non-manufacturing, with risks modestly to the downside if prior typical patterns when the Lunar New Year holidays take place in February are a guide. But all eyes will remain on what, if any, further measures the authorities take to bolster the economy, property sector and domestic equity market. A busy week in Japan is expected to see tourism and import price base effects drive headline and core ex-Fresh Food CPI below 2.0% to 1.9% y/y for the first time since the end of Q1 2022; core ex-Fresh Food & Energy will likely remain elevated at 3.3% (vs. Dec 3.7%). While wages remain critical to the BoJ policy outlook, the weakness of domestic demand suggests that the BoJ may defer an exit from negative rates until the start of Q3, rather than April as markets are discounting. Retail Sales are seen rebounding 0.5% m/m after a steep drop of -2.9% m/m in December, while the already reported plunge in auto output is seen pacing a sharp -7.0% m/m decline in Industrial Production, most of which should be reversed in February, with labour data forecast to be unchanged and signalling a very tight labour market. Indian Q4 GDP is expected to slow to 6.5% y/y from Q3’s very robust 7.6%, with lower exports, a drop in Agricultural Output and the RBI’s restrictive policy stance, taking shine off ongoing strength in Infrastructure output and support for manufacturing from government subsidies, though risks look to be skewed to a stronger, though still lower outturn. Energy prices (fuel and household utilities) and Insurance costs are likely to bump Australian monthly CPI up to 3.6% y/y from 3.4%, but the downtrend is likely to resume in coming months, while Q4 CapEx is seen slowing to 0.4% q/q from Q3’s 0.6%, with Q4 Construction Output also expected to decelerate to 0.6% q/q from 1.3%. Last but not least, Lunar New Year holiday timing effects will weigh heavily on South Korea’s February Trade data, with Exports seen at 1.5% y/y, and Imports -13.5% y/y, underlying trends should still suggest that the recovery in Trade seen in H2 2023 remains very much intact, as exemplified by further strong growth in Semiconductor exports.

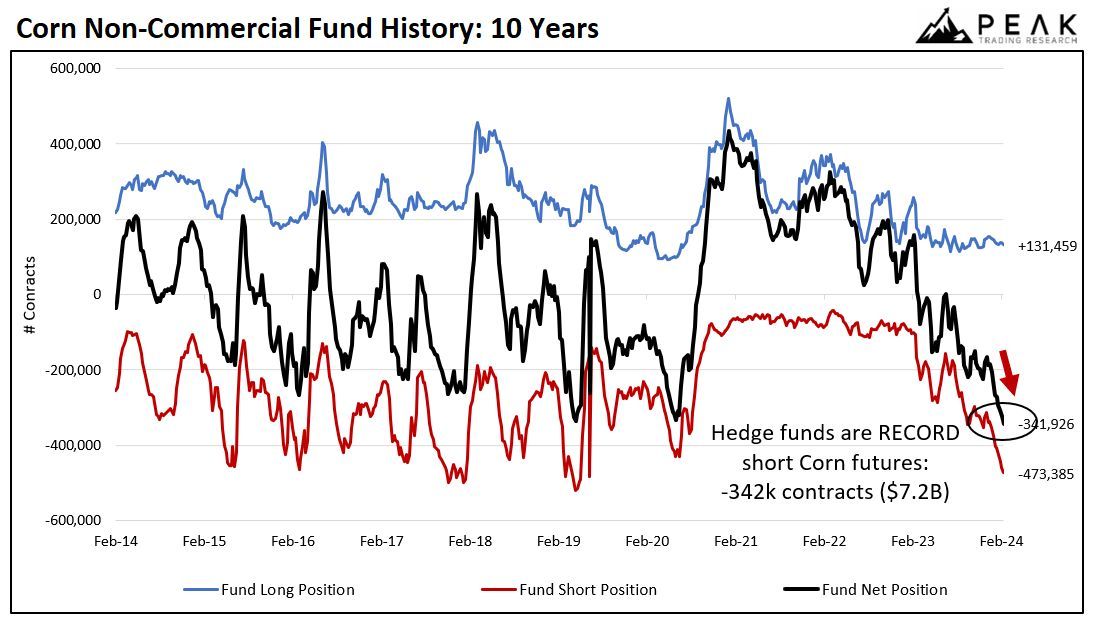

As much as there will be a deluge of Fed, ECB and BoE speakers on tap this week, it seems unlikely that the pervasive air of caution on the timing of initial rate cuts will change, as March policy meetings come into view (BoC March 6, ECB March 7, BoJ and RBA March 19, Fed March 20 and BoE March 21). One can make the observation that this rate caution allied with still enormous economic outlook uncertainty, escalating geopolitical tensions and national election related risks, sit rather uncomfortably with robust equity market risk appetite. But bear in mind that G4 central bank (Fed, ECB, BoJ and BoE) balance sheets have expanded modestly since the start of Q4 2023, after contracting in Q2 and Q3, and that this has been the rocket fuel for asset price inflation for more than a decade. Still, the skew evident in the evaporation of short positions in megacap tech stocks in the US underlines the vulnerability to the myriad of risks, and conversely as does the huge short position in grains & oilseeds (see corn positioning chart).

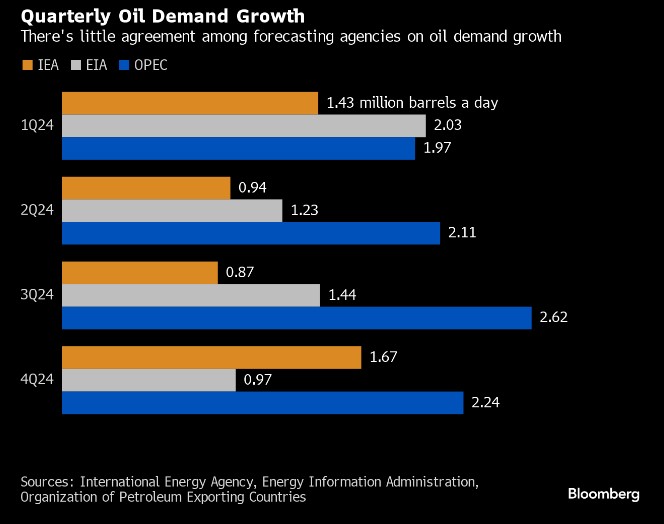

The huge divergence in EIA, IEA and OPEC 2024 quarterly crude oil demand estimates (see chart) is also a striking testament to the level of uncertainty (even if some might debatably argue that this can be attributed to differing political agendas), while the crash and burn in battery metals (perhaps most notably Cobalt and lithium) is a reminder about the risk of ‘herd behaviour’ in what are structurally rather illiquid markets, which are further challenged by the structural shift higher in financing costs. Appearances often deceive, and keeping perspective on risks, above all on complex interconnectivities, has probably never been more important.

Corporate earnings highlights for the week as compiled by Bloomberg News are likely to include: Acwa Power, Aena SME, Agilent Technologies, Alcon, Amadeus IT Group, Ambev, American Electric Power, American Tower, Anheuser-Busch InBev, ASM International, Autodesk, AutoZone, Baidu, Bank of Montreal, Bank of Nova Scotia, Beiersdorf, Berkshire Hathaway, Canadian Imperial Bank of Commerce, Cellnex Telecom, Cie de Saint-Gobain, Constellation Energy, Coupang, CRH, Daimler Truck Holding, Dell Technologies, Devon Energy, Extra Space Storage, Ferrovial, Fidelity National Information Services, Galaxy Entertainment, Haleon, Holcim, Hong Kong Exchanges & Clearing, HP, Kuehne + Nagel International, Li Auto, London Stock Exchange Group, Lowe’s, Munich Re, National Bank of Canada, NetEase, Oneok, OCBC, Public Service Enterprise Group, Reckitt Benckiser Group, Republic Services, Royal Bank of Canada, Salesforce, Sempra, Snowflake, Splunk, Straumann Holding, Sun Hung Kai Properties, TJX, Toronto-Dominion Bank, Uniper, Universal Music Group, Veeva Systems, Woodside Energy Group, Workday and Zscaler.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

© 2024 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.