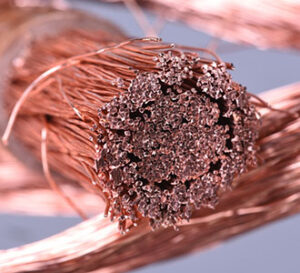

COPPER

Weaker than expected European data and ongoing negative divergence by Chinese equity markets versus world markets leave the bears hopeful early today. In a minimal negative demand development, the monthly German Ifo survey readings came in well below estimates and last month’s readings, which helps the dollar and erodes hope for improving copper demand outside of China. However, Chinese demand remains suspect with the Bloomberg Chinese Activity Index dropped sharply this month as China’s home sales slumped once again. Therefore, this morning’s US NAHB Index will be a more important than normal factor for copper as US housing is at the forefront of copper demand. The market expects a slight rise in the NAHB to 37. While March copper is overbought from last week’s early surge higher, an entrenching pattern of noted daily declines in daily LME copper warehouse stocks, global central bank dovishness and the ability to hold above two critical moving averages recently gives the bull camp a residual edge. From a classic technical perspective, the short-term technical outlook for copper favors the bull camp with the rise above the 200-day moving average last week forged on jump in trading volume and an expansion of open interest.

GOLD & SILVER

Despite a lack of direction in the dollar in the early going today, the gold market remains vulnerable on its charts but supported by global central bank dovishness. While we suspect gold and silver will take a huge amount of direction from the dollar and from US treasuries there is a developing physical demand threat from ongoing malaise in the Chinese economy. The struggling Chinese economy is partially verified by ongoing weakness in Chinese equity markets relative to the very impressive gains in global equity markets. From a technical perspective, the gold market is very vulnerable with the latest net spec and fund long position (adjusted for the $67 rally from the report calculation) easily reaching the highest levels of 2023. The March silver contract continues to waffle around its 200-day moving average which sits at $24.26, with the silver market potentially less vulnerable than gold because of the optimism thrown off by surging global equities and ideas of a “Fed put”. Unfortunately for the bull camp, the net spec and fund long in silver is also elevated with the current net spec and fund long within 4,000 contracts of the 2023 high.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.