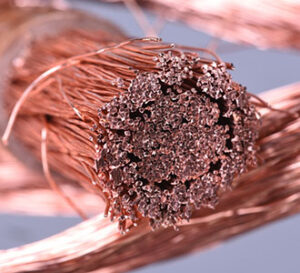

COPPER

While LME copper warehouse stocks have continued a very definitive pattern of daily copper stock declines, information on the Chinese economy has been suspiciously absent this week with new loans and direct foreign investment readings not published as expected. Certainly, the trade could be cheered by news that Chinese copper output last month increased following maintenance (Chinese industrial activity is managed by the government as increased production must be needed), with the 3.9% gain from the previous month likely attributable to the catch up for lost production during maintenance. We think it is best to assume that no news from China is bad news for their economy and in turn leaves copper under a cloud of potential liquidation selling. In fact, with a fresh lower low for the move in March copper yesterday, the charts continue to present a negative technical tilt.

GOLD / SILVER

While events that are widely anticipated to present significant volatility can sometimes be disappointing with a muted response, the stakes for many financial markets are significant today as the pendulum of expectations for an early US rate cut have been pulled down with a series of US Fed speeches generally indicating the fight against inflation is not complete yet. Fortunately for the bull camp in gold and silver, the action in bond and dollar markets this week has not shifted definitively bearish from the reduction in rate cut expectations but today presents a possible breakout session with a dollar trade above 102.385 a big problem for the bull camp. On the other hand, a trade in the dollar below 101.835 could save the day for the bull camp and launch February gold above $2050.0 It should be noted that the markets did see some positive demand news from the central bank front yesterday with Poland apparently increasing their gold reserves by 130 tonnes last year. However, central bank purchases, chart action, ETF flows, and an overbought spec and fund long positioning in gold futures are likely to be secondary to a possible chain reaction following the December US CPI report. Expectations call for inflation at the consumer level to increase by 0.2% with the markets likely to be very sensitive to variations of 0.1% from the report. While the US CPI data might not result in a significant market reaction, it is possible that weekly initial claims could break out the downside to levels seen since early October, which could be countervailed by an as expected US CPI thereby leaving gold and silver under pressure.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.