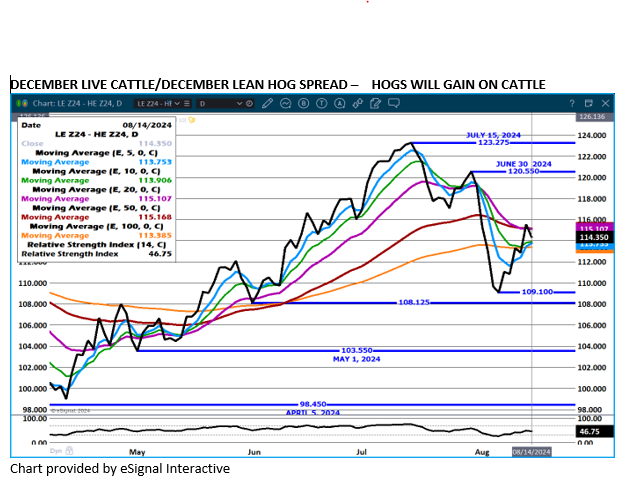

MORNING LIVESTOCK FUTURES OUTLOOK

LIVE CATTLE

Wednesday choice beef was down $2.05. On Monday and Tuesday it looked as though the beef market was turning higher. Feedlots were talking steady to higher cash cattle prices because of it and it looked like beef buyers were beginning to stock up supplies for Labor Day. Wednesday choice primal loins took a big hit to the downside and dropped $11.37.

As summer temperatures decline into fall, cattle feed efficiency will improve. Slaughter will also start to tick up with more cattle expected. There will be more cattle and heavier cattle. Australia and Brazil need to increase beef imports to the US.

LEAN HOGS

The CME Lean Hog Index and CME Pork Index have been steadily falling. Most concerning is the difference with pork prices falling faster than hog prices and cutting packer profit margins. All cash hog negotiated prices are below $90.00. The simple weighted average price is $87.70.

As the summer heat moves to cooler temperatures, weights will increase quickly adding at least 5 to 6 pounds to hogs. Canada is increasing sales to the US.

>>Read full report here

Interested in more futures markets? Explore our Market Dashboards here

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.