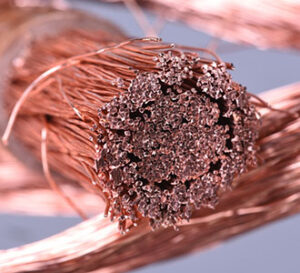

COPPER

With trading volume on recent strength moderating, copper prices could be at a temporary top. In fact, with the extended Chinese holiday just getting underway, buying activity from China could moderate with would be buyers potentially waiting for a correction to extend forward coverage. However, a Goldman Sachs price forecast for copper should provide a measure of support for copper with Goldman Sachs projecting average 2023 copper prices to be 4% above current London prices. Goldman also looked favorably on aluminum with optimism toward Chinese demand clearly built into the bull case since the initial announcement of a lessening of Chinese activity restrictions. However, with Chinese government estimates projecting 2 billion “trips” for the holidays the trade will be looking for a surge in daily Chinese infections. From the demand side of the equation India overnight posted a 27% demand increase in 2022 versus 2021 as Indian domestic copper production is limited. Upcoming Indian imports are likely to strengthen further following government efforts to boost power infrastructure which last year resulted in a 75% year-over-year growth in copper demand for the power sector.

GOLD / SILVER

While the US dollar is not weak enough to provide definitive lift for gold, startling demand news was presented overnight with reports that Swiss exports of gold reached multiyear highs in 2022. More importantly, Swiss exports of gold to China were pegged at 524 tons up from only 354 tons in 2021 and the highest tally in 5 years! In conclusion, demand for the largest consumer of gold was solid last year despite a lack of Press coverage on the subject. Unfortunately for the bull camp November Swiss export figures showed a 79% decline in Indian gold imports. After a string of daily outflows from gold ETF instruments, Monday saw an inflow of 276,181 ounces bringing the year-to-date tally to a “flat” reading. Silver ETF holdings saw a notable inflow of 2 million ounces, but year-to-date holdings are still down 1.2%. Unfortunately for the bull camp, Indian gold buyers overnight backed away after a new high in gold valued in rupees, which is clearly a pattern in the Indian gold trade. In retrospect, the gold market deserved a measure of back and fill technical balancing after last week’s stellar rally. In fact, seeing the US dollar recoil from a potential downside breakout on the charts yesterday should temporarily increase overhead resistance and potentially entice profit-taking in the bull camp with a failure of support at $1,938. At present, we see gold and silver as classic physical commodity markets needing progressively lower dollar action, a notable expansion in global uncertainty or a significant drop in US treasury yields to finish the month of January as strong as the market started out the month.

PALLADIUM / PLATINUM

While the platinum market was unable to extend the recent pattern of higher highs yesterday, the bull camp regained its footing with a 4 day high early today. Fortunately for the bull camp, hope for increased investment interest in platinum remains in place, especially after several recent notable daily inflows to platinum ETFs. Yesterday platinum ETF holdings saw another daily inflow of 1,928 ounces but holdings are still down 0.7% year-to-date. However, the net spec and fund long position in platinum remains overbought leaving the market vulnerable to cascade selling if key chart support levels are violated. The palladium market continues to face consistent selling from rumors that some manufacturing demand for palladium has shifted to cheaper priced platinum. Fortunately for the bull camp the speculative trade in palladium futures continues to hold a moderate net spec and fund short which could temper stop loss selling pressure if key support levels are violated.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.