London Wheat Report

Slow news days today so more re-runs of the old story we have seen of late. ‘’ Russia is flooding the global market with cheap wheat as the world’s No. 1 supplier draws down inventories ahead of an expected bumper harvest, easing food inflation for importers but intensifying competition for rival exporters.’’

Ukraine’s agricultural maritime exports in March are expected to fall by 20% from February. According to data released, if the current March export rates continue they will be 20% lower than a month previous.

Grain market players are reporting that China has cancelled some U.S. wheat purchases, France’s farm office said on Wednesday, in a move that could be in response to a recent slide in prices. The market players cited the cancellations in a monthly supply and demand meeting with FranceAgriMer. There was some confusion if this was French or US wheat but the French reported it was US wheat. USDA didn’t give this in their daily cancellations. Some confusion.

Rapeseed had a very strong day yesterday trading up 13 euros on the May at one stage, settling well up. Today it gave back half of those gains. Matif wheat was yoyoing around today up down and sideways but the overall tone was downward.

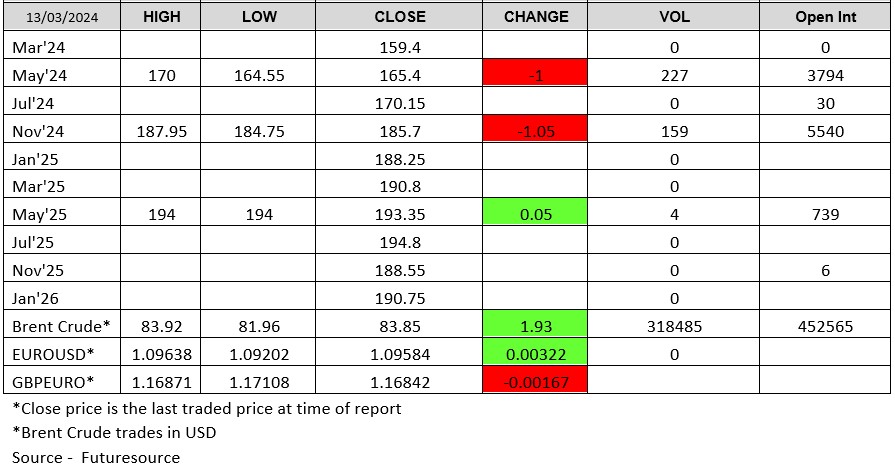

London had an opposite day to yesterday, by starting stronger and the falling back into the red after lunch. Volume wasn’t where it was yesterday with only 400 odd lots crossing the line. May/ Nov spread still stands unchanged as both May and Nov both fell around £1.00. May 25 traded today for 4 lots at £194.00.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook or Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.