SOYBEANS

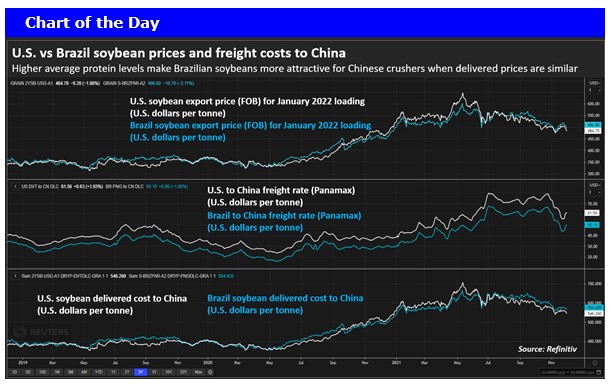

Soybeans traded higher on talk of drier S Brazil and NE Argentina weather. Strong domestic US soybean and soymeal basis also offered support. Higher Canada Canola prices and talk of higher demand for US soyoil helped soyoil. No analyst has yet dropped either Brazil or Argentina crops due to the dryness. There is also talk that China may have bought a few US Dec/Jan soybean cargoes. In November, soybean futures range was 11.71-12.89, nearby soymeal 328-382 and soyoil 54.67-62.49. Key now is South America weather. Trade estimates US 2021/22 soybean carryout near 355 mil bu vs USDA 340. Range is 300-411. Trade also estimates World soybean end stocks near 104.9 mmt vs 103.8. Range is 103.1-105.2. USDA report is Dec 9. Stats Canada est their canola crop at 12.6 mmt vs 12.8 previous. Winnipeg futures gained 10 at 1030. Contract high is near 1056.

CORN

Corn futures ended higher. Here again market may be adding some weather premium due to a drier than normal 2 week weather forecast for most of S Brazil and NE Argentina. US domestic corn basis remains firm on good ethanol demand and margins. Weekly US corn export sales of 1.2 mmt was supportive. There are rumors that China may be seeking US corn due to wet Ukraine corn quality. There is talk that China may have bought 250 mt US corn. There is also talk that China may also be bidding for 500 mt Ukraine corn. The prices including freight is a premium to US and highest feed grain price in World. In, November corn futures range was 5.47-5.89. Drier SA weather could help CH test 6.00. Argentina raised the corn crop rating to 90 pct G/E with 31 pct of the crop planted. This was a surprise given the drier weather. Next week, Argentina will issue a 2 year Ag plan that may not include export taxes. Trade estimates US 2021/22 corn carryout near 1,475 mil bu vs 1,493. Range is 1,300-1,576. Key could be USDA est of US exports and ethanol use. Trade also estimates World corn end stocks at 304.5 mmt vs 304.4. Range is 300.0-307.0. Matif corn futures were higher on talk of lower EU supplies.

WHEAT

Wheat futures traded lower. A little higher estimate of Canada wheat crop and talk US may not be competitive for a new crop Saudi Arabia July, 2022 tender triggered selling. Row crops gained on concern over S America weather and talk of increase China interest in US soybean and corn. WH ended near 8.03.Range was 7.96-8.22. KWH ended near 8.26. Range 8.21-8.48. MWH ended near 10.20. Range was 10.19-10.42. In November. KC futures range was 7.74-8.87. Outlook for higher EU and Russia prices and potential for dry US 2022 plains should support prices. Russia announced new wheat exports at14 mmt. 9 mmt Feb 15-June 30. That would suggest total exports closer to 32.0 mmt vs USDA 36.5. Trade estimates US 2021/22 wheat carryout near 589 mil bu vs 583. Range is 563-632. Trade also estimates World wheat end stocks near 276.0 mmt vs 275.8. Range is 270.0-279.0.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.