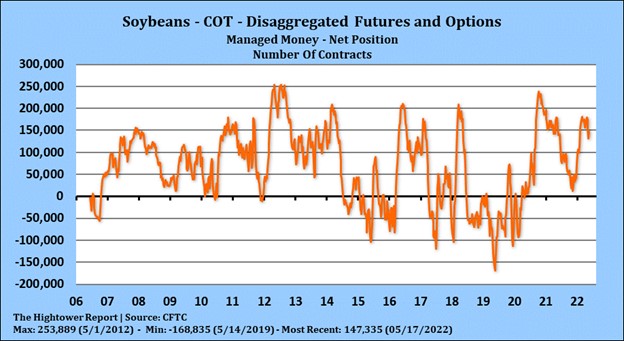

SOYBEANS

Soybean futures ended lower. There is concern that comments by US President concerning support for Taiwan and China tariffs may cause reduced relations between US and China. US April combined US soybean use was a record 305 mil bu and up 38 pct from last year. Some could see US soybean exports closer to 2,200 mil bu vs USDA 2,140 and carryout near 190 vs USDA 235. Trade est US soybean plantings near 49 pct vs 30 last week. Weekly US soybean exports are down 13 pct from last year. July soybean open interest has increased 25,000 contracts from May 9 when SN was near 15.78 to recent high near 17.34. 20 and 50 DMA are near 16.50.

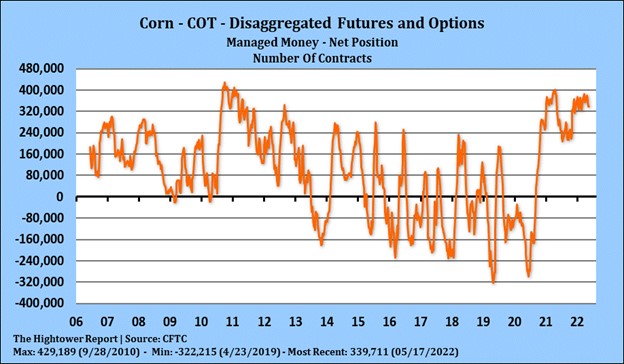

CORN

Corn futures ended higher. Fact Russia denied UN request for a corridor to allow Ukraine exports may be supporting corn futures. Higher US equities may also be helping corn bounce off Fridays lows. Some could see US corn exports closer to 2,700 mil bu vs USDA 2,400 and carryout near 1,300 vs USDA 1,440. Trade est US corn plantings near 68 pct vs 49 last week. US corn exports are down 17 pct from last year. US census corn exports though are 266 mil bu higher than inspections. CN has seen a small increase in open interest of 30,000 contract from the May 10 low near 7.69 to recent high near 8.10 on May 16. USDA lower than expected estimate of US 2022 corm yield near 177 triggered new buying. Some feel the last 30 pct of the crop that is left to be planted could be slowed due to wet weather. That could raise doubt that final US corn yield will be 177. 50 DMA support is near 7.66. 20 DMA resistance is near 7.93. Strong US jet stream is keeping Midwest wet and reduces chance for a lasting high pressure ridge to set in. Still some could see net drying this summer across parts of US west Midwest. Brazil remains dry. Parts of EU is dry.

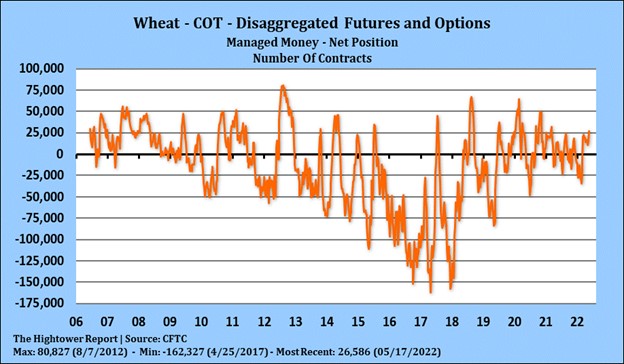

WHEAT

Wheat futures ended higher. Fact Russia denied UN request for a corridor to allow Ukraine exports may be supporting wheat futures. Higher US equities may also be helping wheat bounce off Fridays lows. Trade est US spring wheat plantings near 56 pct vs 39 last week and winter wheat crop rated 28 pct G/E vs 27 last week. US wheat exports are down 20 pct from last year. WN had an inside day and ended near 11.90. Open interest increased after USDA report 20,000 contract. WN rallied from a low on May 12 near 11.68. to a high on May 17 near 12.08. Lower US equities triggered long liquidation in wheat. KWN also had an inside day between 12,51 and 13.00 and ended near 12.77. Some feel lower World 2022 wheat supply and higher demand could push KWN in a 13.00-14.00 range post US harvest. MWN also had an inside day between 12,76 and 13.00 ending near 12.98. Forecast of more rains in ND and east Canada prairies supports MWN.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.