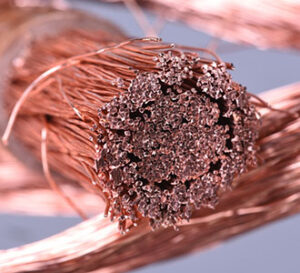

COPPER

We see the copper market becoming overvalued from both fundamental and technical perspectives. In fact, with LME copper warehouse stocks continuing to post daily inflows and Shanghai weekly copper stocks last Friday jumping by 18.5% the tight supply theme continues to erode. In another bearish development, Codelco has apparently ended its long-term contract to sell copper concentrate to Chinese clients in 2025. Certainly, a revitalization of Chinese economic optimism justified a portion of last week’s rally, but we doubt that positive vibe can remain in place again this week. The most recent COT positioning report showed the copper market nearly balanced, especially if the report is adjusted for the $0.05 rally into last week’s high. The September 12th Commitments of Traders report showed Copper Managed Money traders went from a net long to a net short position of 3,768 contracts after net selling 7,672 contracts.

GOLD / SILVER

While the dollar has not make a fresh high for the move since last Thursday, the currency index remains near upside breakout territory. With treasury yields also breaking out to the highest level since August 22nd overnight and sitting within one point of contract lows, renewed strength in the dollar should not be discounted. In short, outside market forces continue to favor the bear camp in gold and silver with internal bullish fundamentals incapable supporting prices or are simply completely absent. With the December gold contract trading $180 below the level where the 2023 low net spec and fund long position was registered in May, the gold market is vulnerable to further stop loss selling by specs and funds. Like the gold market, the silver market has little in the way of fresh fundamental news, especially bullish fundamental news. Certainly, there was a moment last week when silver saw an outsized rally off hope for Chinese stronger demand. With the net spec and fund long position in silver pretty much in the middle of the last 6 months range, the market is somewhat balanced technically. The September 12th Commitments of Traders report showed Silver Managed Money traders net sold 12,794 contracts and are now net long 1,184 contracts. Non-Commercial & Non-Reportable traders are net long 31,216 contracts after net selling 6,313 contracts. Last week silver ETF holdings increased by 1.7 million ounces but remain 5% lower year-to-date.

PLATINUM / PALLADIUM

In retrospect, the massive rally in platinum on Friday lifted prices $30 from last week’s low and the market forged the rally on increased volume but a decline in open interest. In our opinion, the bull camp is small in numbers, especially with the potential cut back in auto catalyst demand given the United Auto Workers strike in the US. However, Chinese economic chatter overnight has turned slightly positive after calls from the IMF for the Chinese government to begin focusing on personal consumption instead of infrastructure programs. Platinum positioning in the Commitments of Traders for the week ending September 12th showed Managed Money traders went from a net long to a net short position of 5,100 contracts after net selling 12,310 contracts. Non-Commercial & Non-Reportable traders net sold 7,227 contracts and are now net long 12,279 contracts.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.