TODAY—WEEKLY EXPORT SALES–

Overnight trade has SRW Wheat down roughly 7 cents, HRW down 5; HRS Wheat down 4, Corn is down 7 cents; Soybeans down 9; Soymeal down $3.00, and Soyoil down 60 points.

Chinese Ag futures (May) settled up 30 yuan in soybeans, up 19 in Corn, up 8 in Soymeal, up 92 in Soyoil, and up 140 in Palm Oil.

Malaysian palm oil prices were down 60 ringgit at 3,817 (basis March)

In Brazil, conditions are still expected to be mostly favorable for crop development, with some pockets that are a little drier than preferred in an area from Rio Grande do Sul into Parana and greater dryness in northeastern Bahia.

Rain in Argentina will be more meaningful with greater coverage Sunday through Monday due to a frontal boundary. The rain will be beneficial and needed; though, there will still be some pockets that don’t receive much moisture. The rain may be greatest in northern and west-central Argentina with less than preferred in the south.

The player sheet had funds net sellers of 5,000 SRW Wheat; bought 12,000 Corn; net bought 12,000 Soybeans; bought 5,000 lots of Soymeal, and; bought 3,000 lots of Soyoil.

We estimate Managed Money net long 42,000 contracts of SRW Wheat; long 394,000 Corn; net long 264,000 Soybeans; net long 104,000 lots of Soymeal, and; long 131,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 7,300 contracts; HRW Wheat up 2,500; Corn up 35,500; Soybeans up 14,900 contracts; Soymeal up 3,000 lots, and; Soyoil down 4,100.

Deliveries were ZERO Soymeal; ZERO Soyoil; Rice 1; and 1 Soybean.

There were no changes in registrations—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 76; Soyoil 1,313 lots; Soymeal 175; Rice 458; HRW Wheat 91, and; HRS 1,023.

Tender Activity— Jordan seeks 120,000t optional-origin wheat—

U.S. Ethanol production for the week ended Jan 1 was 935,000 bls per day, up 0.11% vs a week ago, down 11.9% vs yr ago

—Stocks were 23.3 mil bls (down 0.94% vs week ago, up 3.7% vs yr ago)

—Corn use was 94.5 mil bu (94.4 mil last, 97.5 mil needed to meet USDA projections)

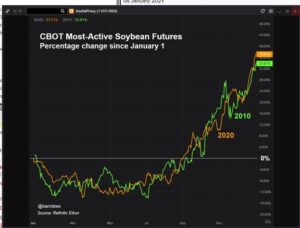

Wire story reported Chicago-traded corn and soybeans ended 2020 with a bang and the fireworks have continued into 2021. The unprecedented rally has many traders and analysts cautiously anticipating where prices will head next, and rewinding the clock by a decade might reveal some possibilities.

World food prices rose for a seventh consecutive month in December, with all the major categories, barring sugar, posting gains last month, the United Nations food agency said. The Food and Agriculture Organization’s food price index, which measures monthly changes for a basket of cereals, oilseeds, dairy products, meat and sugar, averaged 107.5 points last month versus 105.2 in November. The November figure was previously given as 105.0. For the whole of 2020, the benchmark index averaged 97.9 points, a three-year high and a 3.1% increase from 2019. It was still down more than 25% from its historical peak in 2011. Vegetable oil prices continued recent strong gains, jumping 4.7% month-on-month in December after surging more than 14.0% in November. For the whole of 2020, the index was up 19.1% on 2019.

Cold damages may be observed in localized wheat areas in China amid recent cool and dry weather – Refinitiv Commodities Research

2021/22 CHINA WHEAT PRODUCTION: 138 [133–142] MILLION TONS, unchanged from last update

The union representing Argentine port-side grain inspectors will meet on Wednesday with agro-export companies to try to clinch a wage deal that would end a strike that started on Dec. 9, a union representative said. The month-old work stoppage by the labor group, known by its Spanish acronym Urgara, has hit port operations in one of the world’s top exporters of soybeans, corn and wheat.

USDA attache sees Argentina 2020/21 soy crop at 50 mln tonnes – Reuters News

Disappointing rainfall continues to lower Argentina corn production as growing season begins – Refinitiv Commodities Research

2020/21 ARGENTINA CORN PRODUCTION: 45.0 [39.5–49.7] MILLION TONS, DOWN <1% FROM LAST UPDATE

Ukrainian sunflower oil export asking prices added $75-$85 per tonne over the past few days, jumping to as much as $1,315 per tonne FOB Black Sea, analyst APK-Inform said ; the move is caused by both an increase in the cost of production…and a significant increase in quotations of vegetable oils and oil on international markets; it said that soybean purchase prices also increased by $10 – $15 and reached $485 – $545 per tonne CPT (carriage paid for) Black Sea as of January 6. APK-Inform said this week sunoil export prices for January-February delivery had risen by 9% since early December, buoyed by stable demand from exporters and stood at $1,210 – $1,220 FOB Black Sea as of January 4. The consultancy has increased its forecast for Ukraine’s sunoil production and exports for the 2020/21 season to 6.219 million tonnes and 5.780 million tonnes respectively.

Euronext wheat eased on Wednesday, consolidating after a fresh two-year high, as U.S. futures turned lower and traders waited to see how a grain rally fuelled by South American supply risks would affect export demand. March milling wheat settled down 1.75 euros, or 0.8%, at 216.00 euros ($265.59) a tonne. It had earlier reached 219.00 euros, a new life of contract peak and the highest spot price since August 2018.

Recent rain in central and northern India and rapid planting pace raise 2021/22 India wheat production by 1.4% to a record high at108 [97–113] million tons.

Shares of India’s biggest poultry producer Venky’s dropped more than 4% on Thursday to their lowest level in two months after an outbreak of avian influenza was reported in four states.

Venky’s shares fell for the fourth straight day on Thursday and were trading at 1,515.95 rupees, down 2.85%, after hitting a low of 1495.10 rupees earlier in the day.

Palm oil prices seen at 3,700-3,800 ringgit in early 2021- analyst Mistry – Reuters

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.