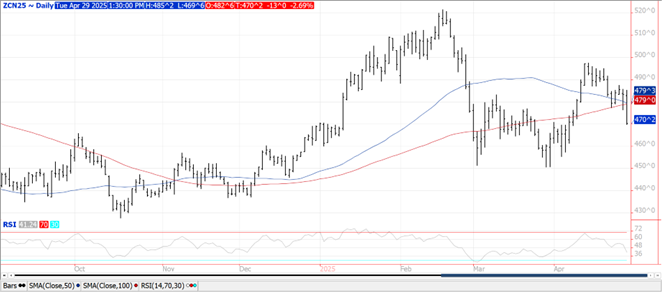

CORN

Prices ranged from $.05-$.15 lower led by old crop futures. Spreads weakened with tomorrow being FND for May futures. May/July traded out to its previous low at a $.10 carry. Coming into today, there were 190 contracts registered for delivery. July-25 plunged to a 3 week low slicing thru the 50 & 100 day MA’s in the process. Trade shrugged off the announced sale of 120k mt (4.7 mil. bu.) to Spain. Favorable weather, rapid planting progress across the US and speculative selling fueled the lower trade across most of the Ag. space. US plantings advanced 12% to 24% complete, below the 25% pace from YA however above the 5-year Ave. of 22%. Plantings were in line with expectations. 5% of the crop has emerged. Plantings across the WCB are above their historical average while IL (-10%) and KY (-13%) remain the furthest behind their respective 5-year averages. Conab est. Brazil’s ethanol production will fall 1% in 2025/26 to 36.8 bil. liters with sugar based ethanol expected to drop 4.2% while corn based ethanol is expected to jump 11%. EU corn imports as of April 27th have reached 17.1 mmt, up 11% from YA. Tomorrow’s EIA report is expected to show ethanol production range from 297-306 mil. gallons LW, vs. 304 mil. gallons the previous week.

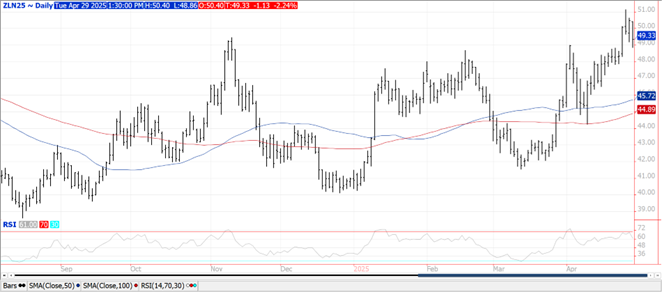

SOYBEANS

Prices were mixed with soybeans down $.08-$.11, meal rebounded $2-$3 while oil pulled back just over $.01 per lbs. Bean and oil spreads were mixed while meal spreads firmed after making a new low in May/July. July-25 beans held support above its 100 day MA at $10.41. July-25 oil fell back to support near $.49 lb. A nice bounce in July-25 meal today however still holding under $300 per ton. Spot board crush margins rebounded $.07 to $1.35 ½ bu. with bean oil PV falling back to 45.7%. Rain over the balance of the week to favor the Southern plains where 1.5”-3” totals will be common, with 1-1.5” coverage for much of the central and ECB. Lighter totals for the NW half of the corn and soybean belt. Much of the nation’s midsection will remain in a warmer than normal pattern into mid-May. Above normal precipitation for the WCB, below normal for the east. The US/China trade war rolls on as China claims they can get by without importing Ag. products from the US. They also aim to cut soybean meal usage in feed rations to only 10%, down from the current 13.5% which was 14.5% just a few years ago. The USDA announced the sale of 110k mt (4 mil. bu.) of soybeans to an unknown buyer. Soybean plantings advanced 10% to a record 18% complete, above the previous record pace from YA at 17% and above the 5-year Ave. of 12%. US farmers are sticking to a growing trend of planting soybeans earlier. Kentucky is the only state who’s progress is below its 5-year Ave. EU soybean imports as of April 27th at 11.5 mmt are up 8.6% from YA. Meal imports at 15.5 mmt are up 25%. The longer the US/China trade war goes on, the more likely we’ll see a significant jump in Brazil soybean acres this fall. Recall the US and Brazil were jockeying as #1 and #2 in global soybean production in the first few years of Trump’s first term. As the trade war evolved, so did the rapid expansion of Brazil soybean plantings. They hold as the global leader in production and exports hasn’t looked back.

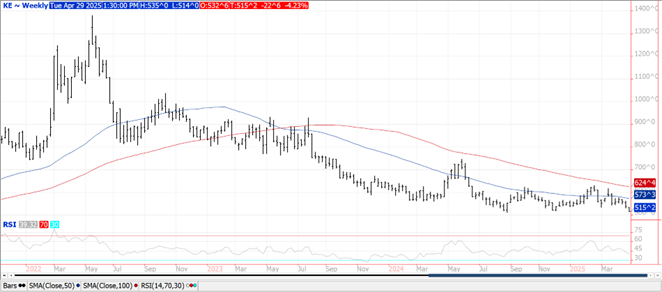

WHEAT

With the exception of May-25 MGEX futures, prices were lower across all 3 classes. KC and CGO were off $.08-$.10 while MGEX is $.05 lower. Fresh contract lows for KC and Chicago, while July-25 MGEX holds just above its contract low at $5.88 ¾. Nearby spreads in Chicago made new lows. Winter wheat conditions jumped 4% to 49% G/E while poor and VP fell 2% to 19%. The rating improvement was better than expected. 27% of the crop is headed vs. 28% from YA and the 5-year Ave. of 22%. Current rating would suggest an average yield of 51.8 bpa and production of 1.350 bil. nearly identical to last year’s crop. Spring wheat plantings advanced 13% to 30% complete vs. 31% from YA and well above the 5-year Ave. of 21%. Russia has called for a 3-day cease fire in their war with Ukraine for May 8th thru 10th, coinciding with the 80th anniversary to the end of WWII. SovEcon raised their Russian wheat export forecast by .2 mmt for the 24/25 MY to 40.7 mmt, still well below the USDA forecast at 44 mmt. They also raised their forecast for 25/26 MY by .6 mmt to 39.7 mmt.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.